Starting with a tiny balance—maybe $100—doesn’t mean your trading journey is doomed to slow crawl. It just means you need a plan that prioritizes survival, consistency, and gradual growth. The goal isn’t a lottery ticket; it’s building a compounding engine that turns small, steady gains into something meaningful over time.

Table of Contents

- Step 1 — Risk management: protect the lifeboat

- Step 2 — Compounding: let wins build on wins

- Step 3 — Find your edge: test, don’t guess

- Step 4 — Journal: review the tape and learn

- Putting the blueprint together

- Additional tips for small accounts

- FAQ

- Final note

Step 1 — Risk management: protect the lifeboat

Think of your trading account as a lifeboat. Every dollar onboard matters. Take on too many passengers—too much risk per trade—and one storm of consecutive losses can sink you. Even a profitable strategy can be destroyed by careless sizing.

The 2% rule is the industry answer for a reason: only risk 2% of your account on any single trade. That small-sounding rule dramatically reduces the chance that a losing streak wipes you out.

To see why, consider a trading simulator that starts with $100 and a winning edge (60% win rate). If you risk 20% per trade, the maximum drawdown in repeated experiments can be around 90%—meaning your account can be effectively destroyed even though the strategy wins more than it loses. Drop risk to 2% and the worst-case drawdown falls to something like 15%, which keeps you in the game.

Key practical rules:

- Never risk more than a small percentage of your account on a single trade.

- Adjust position size as your balance changes to keep that percentage consistent.

- Accept that fast doubling is tempting, but survivability matters more than speed.

Step 2 — Compounding: let wins build on wins

Compounding is the magic that turns base hits into a long-term home run. Treat each small, consistent gain as part of the base that future gains stack on. A $100 account will feel tiny at first, but consistency multiplies value exponentially over time.

Example math to keep things real:

- 1% gain per week compounded for a year ≈ ~67% total gain

- 2% gain per week compounded for a year ≈ account roughly doubles in under a year

Compounding only works when your capital survives. That’s why the 2% rule and conservative sizing matter—one huge loss can stop the engine cold.

Step 3 — Find your edge: test, don’t guess

“Edge” is a fancy word for a repeatable, profitable setup. You can find edges in chart patterns, indicators, order-flow quirks, or specific market behaviors. It doesn’t matter where the idea comes from—the important part is testing it yourself.

When backtesting, capture these metrics:

- Win rate: percentage of winning trades

- Risk-reward ratio: average winner vs average loser

- Expectancy: average money made per trade

- Consecutive loss behavior: how many losers in a row can happen

- Max drawdown: worst historical peak-to-trough decline

Backtesting isn’t fun, but it’s the work that separates hope from actual results. If you want supplemental data on crypto setups, a well-run crypto trading signal service can point out potential opportunities across different blockchains and help you scan faster. Use signals as ideas, then backtest and validate them before risking capital.

Step 4 — Journal: review the tape and learn

Recording trades is not about ego or diary entries. It’s a version-controlled map of your decisions. A good journal answers: where did you enter, where did you exit, was the trade profitable, and why did it work or fail?

Small examples of insights you can only get by journaling:

- Realizing you lose when trading out of boredom at 2pm

- Finding your best returns come from trend-following instead of bottom-picking

- Noticing a recurring execution or order-entry mistake

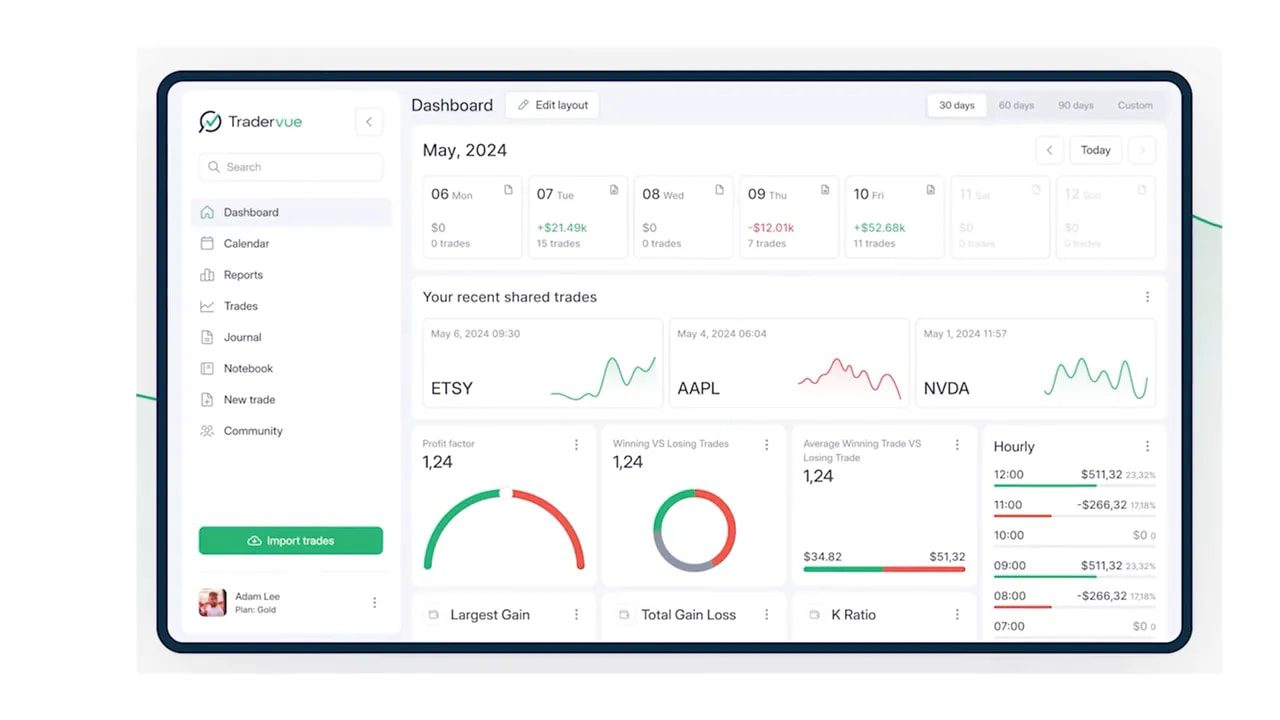

You don’t need fancy software to start. A spreadsheet works. If you want automated metrics, certain platforms let you upload broker statements and analyze winner percentages and profit by setup.

Putting the blueprint together

Here’s the simple, repeatable plan to grow a small account:

- Protect capital: risk a small percentage per trade (2% rule).

- Compound consistently: aim for modest weekly returns and let them stack.

- Backtest an edge: verify win rate, expectancy, and drawdowns before trading live.

- Journal every trade: extract lessons and refine your process.

Follow these rules with discipline. There will be losing streaks, days of doubt, and red P&L nights. That’s normal. The winners are the traders who keep the compounding engine alive long enough for results to show up.

Additional tips for small accounts

- Use low-commission brokers to avoid eating profits on fees.

- Focus on high-quality setups rather than trying to be in every market.

- Scale position size only as your account grows; preserve the percentage risk, not dollar size.

- Keep emotions out of sizing decisions; use a fixed formula for position sizing.

FAQ

How much should I risk per trade?

Risk a small, consistent percentage of your account—many successful traders use the 2% rule. This helps you survive losing streaks and keeps the compounding engine running.

Can I realistically grow $100 into millions?

Technically yes, but it requires an extremely long runway, consistent positive expectancy, discipline, and patience. Focus on building a repeatable process: protect capital, compound small gains, backtest, and journal. Shortcuts that involve reckless sizing usually end badly.

What should I track in a trading journal?

Track entry and exit, position size, stop and target, trade rationale, outcome, and lessons learned. Over time you will identify patterns that raise your edge.

How do I validate a trading strategy?

Backtest it on historical data, measure win rate, average win/loss, expectancy, and max drawdown. Then run it in simulated or paper trading to confirm it behaves similarly in live conditions.

Should I use trading signals for crypto?

Signals can be useful to highlight potential setups across blockchains, but treat them as trade ideas rather than gospel. Backtest and validate any signal before risking capital, and integrate signals into your existing risk and journaling framework.

Final note

This is a long-term game. Growth doesn’t happen overnight; it happens by protecting the lifeboat, compounding patiently, proving an edge, and ruthlessly learning from your mistakes. Apply these rules and your small account stands a real chance of becoming something much bigger.