Table of Contents

- 1 — Macro backdrop: Institutional capital waiting for clarity

- 2 — Bitcoin technicals: swing failure, stair-steps, and what I’m watching

- 3 — Macro catalysts that matter: Fed, politics, and capital flows

- 4 — Money rotation: BTC → ETH → Majors → Alt season

- 5 — The categories I’m buying: ETH, ETH betas, Majors, and Yield

- 6 — My top 15 coins and why (categories and rationale)

- 7 — Deep-dive: Black Hole and on-chain yield mechanics

- 8 — Position sizing, timing, and practical trade ideas

- 9 — Scenario planning: short-term and longer term

- 10 — Common mistakes and psychological pitfalls

- 11 — Playbook summary: my exact actions right now

- 12 — Frequently Asked Questions (FAQ)

- 13 — Final thoughts — the risk/reward and why I’m bullish

Throughout this article I’ll include screenshots showing the relevant charts and on-chain dashboards so you can see the exact setups I reference. If you want the quick answer up front — I’m aggressively buying the dip and focusing on ETH, ETH betas, majors with treasury exposure, and high-quality on-chain yield protocols. But keep reading because the detail matters. The crypto trading signals for these coins have already been shared by our team of expert traders in our premium subscribers’ portal.

1 — Macro backdrop: Institutional capital waiting for clarity

The single most succinct point I’ve heard from institutional allocators is: they hold roughly 1% of portfolios in Bitcoin, and they would raise that allocation to 5–10% with simple regulatory clarity. That is a seismic observation. It answers the question of why many are asking which crypto will explode — the supply of sidelined capital is enormous and it’s patiently waiting for legal certainty.

Regulatory clarity is the faucet for institutional flows. Once small pieces of compliance or regulation snap into place, trillions of dollars of capital sitting in money markets and short-term bonds could start to reallocate. The size of that pool is massive — think of money market balances north of $7 trillion. As that capital looks for higher returns, crypto is a logical place it will go.

That means when you ask which crypto will explode, remember that macro demand can lift entire sectors. In past cycles, the initial push often came from BTC and then rotated to ETH and large-caps before moving into riskier, high-beta alts. This time, we’re seeing the start of that rotation.

2 — Bitcoin technicals: swing failure, stair-steps, and what I’m watching

On the weekly time frame recently, Bitcoin posted a high near roughly $123,000, poked above that level, and then retracted into the prior diagonal range. Traders labeled that a swing failure pattern — a common occurrence in crypto’s price history. Swing failures can be meaningful, but history also shows many swing failures early in a move were followed by fresh legs higher. Which crypto will explode often depends on Bitcoin proving its next leg.

Think of the last couple of years as stair-step behavior: breakout, consolidation back to the breakout midpoint, another breakout, then consolidation to the next base. This pattern creates multiple opportunities to buy dips. If BTC breaks down below a meaningful support zone (for example, the $100k–$110k area), that would create panic and an excellent buying opportunity. But if it holds and re-accelerates, that leg will fuel ETH and then majors and alts.

Short answer on the technicals and the question which crypto will explode: Bitcoin leads the risk-on sentiment. If BTC prints a convincing leg higher — call it the 135k–160k range as an expected move — it will catalyze a rotation into ETH and then high-beta alts.

3 — Macro catalysts that matter: Fed, politics, and capital flows

Interest rates are the rocket fuel for risk assets. If we get a material rate-cut cycle in the U.S., capital will move out of cash/bills and chase higher returns in equities and crypto. Large banks are forecasting several cuts into 2025, possibly bringing the benchmark rate down materially — that would be a major catalyst for the next leg of crypto’s bull run.

At the same time, politics plays a role. Pressure on Federal Reserve governors and potential changes to the composition of the Board could alter policy decisions. Even rumor and political action have the power to change market expectations on rate timing. That’s why you should watch macro-policy news and the Fed voting dynamics — they can indirectly determine which crypto will explode next by controlling liquidity conditions.

4 — Money rotation: BTC → ETH → Majors → Alt season

Historically the flow has been BTC leading, ETH rotating next, majors gaining traction after ETH validates the narrative, and finally the broad alt seasons ignite. Coinbase’s research explicitly points to a potential full-scale altcoin season, contingent on easing and renewed retail participation. When asking which crypto will explode, the rotation pattern gives you a roadmap:

- Bitcoin re-acceleration: confirms risk-on

- ETH catches up and breaks higher: drives protocol narratives

- Majors (large market-cap tokens with real use) rally next

- ETH betas and high-beta alts explode during manic phases

If that pathway plays out, the timing of rate cuts will determine the pace: earlier cuts compress the timeline (fast mania), delayed cuts could stretch the cycle into 2026 or beyond (a longer supercycle). Either way, the Q4 window is historically productive — which is why I consider this dip an aggressive buy opportunity.

5 — The categories I’m buying: ETH, ETH betas, Majors, and Yield

I’m concentrating capital into four primary buckets: ETH, ETH betas (protocols that act like ETH exposure on steroids), majors (network tokens with strong fundamentals and treasury co strategies), and high-quality yield protocols. Here’s why each matters and how they fit into the macro rotation that answers which crypto will explode.

5.1 ETH: The core long

Ethereum remains my largest concentration. ETH is the primary collateral and computation layer for a wave of institutional products and treasury plays. When institutional capital decides to enter crypto more broadly, ETH will be one of the main recipients of that allocation. So when considering which crypto will explode, ETH is a leading candidate and the bedrock of many others.

5.2 ETH betas: treasury coin plays and institutional proxies

ETH betas are assets that move more than ETH during asymmetric market moves. These include treasury-backed vehicles, ETF-like plays for institutional ETH exposure, and some protocol tokens with treasury operations. BMNR (a treasury coin example mentioned) is a prototypical ETH beta. These tokens have the potential to outperform ETH on the upside due to leverage and concentrated treasury strategies.

BMNR pumped aggressively, then corrected — a classic volatility pattern. If ETH continues upwards, these treasury plays typically amplify ETH’s move. Use position sizing caution: ETH betas can outperform massively and also crash more deeply. For readers asking which crypto will explode, ETH betas are likely to be among the top performers in the early alt rotations.

5.3 Majors: Chainlink, BNB, TON, Avalanche, Solana, Cardano

Majors are the largest non-BTC and non-ETH assets that institutional players are comfortable owning. They offer a balance between risk and recognition, and many now have treasury co structures. These tokens are often the next in line for repricing after ETH moves. I’m watching Chainlink, BNB, TON, Avalanche, Solana, and Cardano closely as primary candidates for strong appreciation.

Chainlink has been one of the best performers recently due to real-world asset integrations and enterprise engagement. BNB’s chart and ecosystem traction give it huge potential. TON’s new treasury vehicle positions it for institutional-like flows. Avalanche is building a revenue-generating base and currently trades at discounted levels relative to potential. Solana remains a key narrative survivor with strong developer activity. Cardano presents deep value and upside potential if the narrative resumes.

5.4 Yield: the passive route and emotional hedging

Yield products provide income that helps to reduce the emotional pressure of trying to time every top and bottom. Yield strategies can keep you invested while smoothing volatility, which is invaluable in fast markets. That’s why I’m highlighting on-chain yield protocols that distribute real trading revenue to token holders — these can compound in bull regimes and provide durable returns in sideways markets.

When you ask which crypto will explode, consider yield protocols that scale with usage. If a chain experiences an alt season, revenue-incentivized tokens can multiply returns dramatically because the fee flows increase as trading volume spikes. The key is to focus on protocols with real revenue and transparent mechanisms for distributing that revenue to holders.

6 — My top 15 coins and why (categories and rationale)

Below is a categorized list of the coins I’m most focused on for the near-term run. These recommendations emphasize structural narratives (treasury plays, real yield, network effects) rather than pure meme speculation.

- Bitcoin (BTC) — The macro risk-on tone setter.

- Ethereum (ETH) — Protocol, collateral, and the institutional on-ramp hub.

- BMNR (ETH beta example) — Treasury play that amplifies ETH moves.

- Chainlink (LINK) — Oracle infrastructure and real-world asset integration.

- BNB — Major exchange token with strong treasury and chain usage.

- TON (Toncoin) — New treasury vehicle, communications network with developer momentum.

- Avalanche (AVAX) — Discounted network with strong DeFi and subchain potential.

- Solana (SOL) — High throughput chain with gaming and NFT narratives.

- Cardano (ADA) — Deep value, development and long term upside.

- Aerodrome (AERO) — Example of early alpha that doubled and shows how revenue-driven tokens can pop.

- Uniswap (UNI) — Leading DEX protocol benefitting from DeFi rotation.

- Sushi/Syrup (example) — Top DeFi protocol, value ranges to scoop.

- Aave (AAVE) — DeFi lending leader, steady zigs and zags heading higher.

- Coinbase (COIN) — Exchange exposure, benefits from centralized-onramp demand.

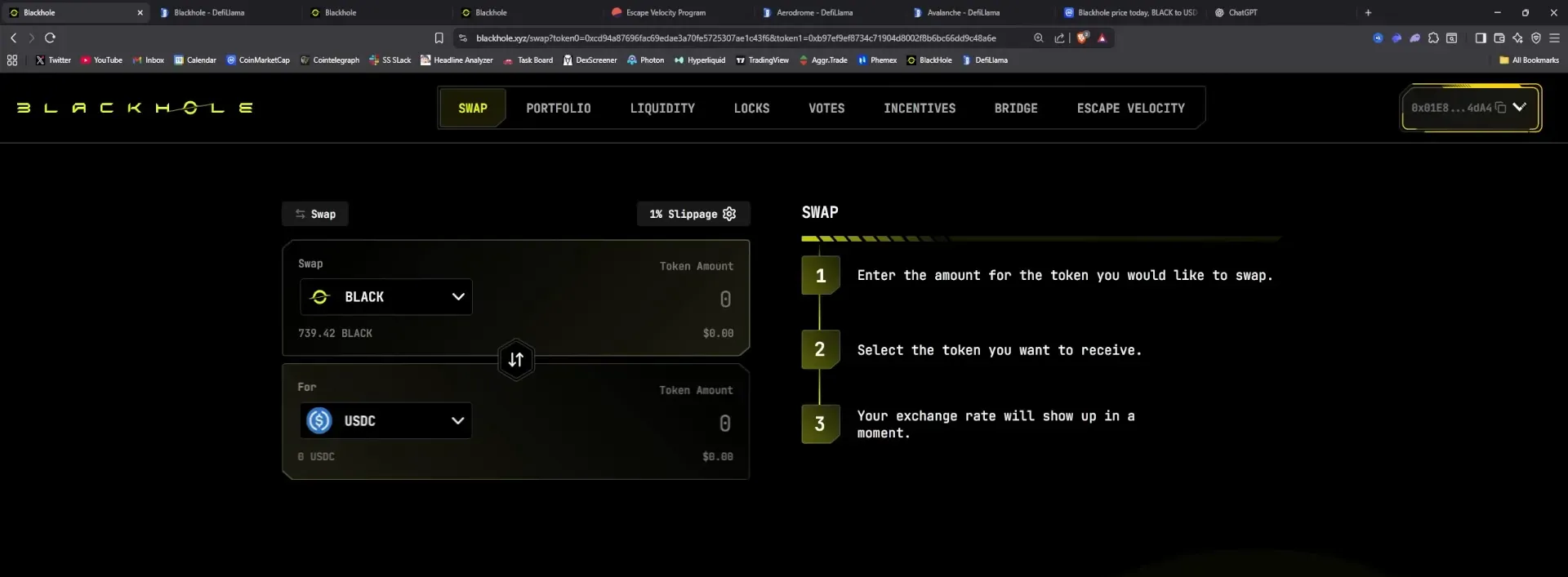

- Black Hole (VBlack) — Yield/Revenue Share Token — High-yield staking/locking mechanism that converts fees into holder revenue.

These are not all equal risk. BTC and ETH are the foundational positions. Majors like Chainlink, BNB, and SOL are mid-risk. ETH betas and newly launched revenue tokens are higher risk but higher potential reward. Which crypto will explode depends on whether you want safety (BTC/ETH), acceleration (majors), or explosive potential (ETH betas and yield tokens).

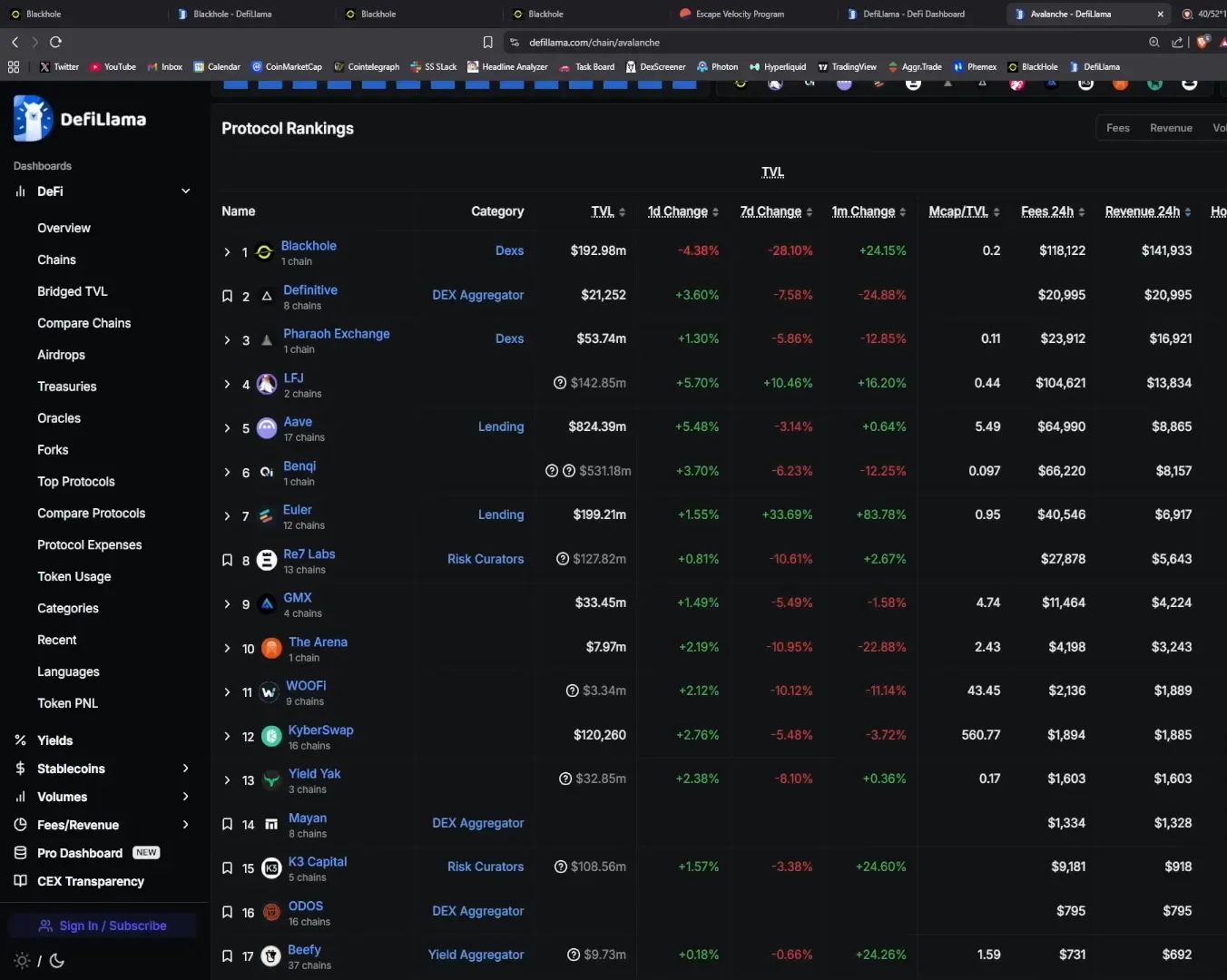

7 — Deep-dive: Black Hole and on-chain yield mechanics

One of the most transformational elements of this cycle is the rise of revenue-sharing, token-burning, and governance-locked yield mechanisms. Black Hole (a case study here) illustrates the model: trading revenue flows into a treasury and is redistributed to holders who have locked and burned tokens for voting power. That creates real, recurring yields.

Here is the math methodology I used to evaluate the payback period and why yield matters. With an initial hypothetical stake valued at $10,000, I collected weekly distributions that, in the current environment, implied a full payback in roughly 44 weeks without rebates. However, the protocol’s rebate program (Escape Velocity Rebate) boosts the effective locked voting tokens when you burn, shortening the payback to as little as 20–30 weeks if rebate conditions are favorable.

Why this is important: at scale, revenue-yield tokens convert market activity into predictable passive streams. If the underlying chain or protocol sees a 5x–10x increase in volume during alt season, these distributions can skyrocket, turning a nine-month theoretical payback into a handful of weeks.

Data points: on-chain revenue dashboards show certain revenue models rank among the top protocols by holder revenue. That’s not just noise — it’s validation that real fee-generating businesses on-chain can sustainably distribute yields. The advantage is psychological as well: you’re less compelled to time the market because your holdings pay you while you wait.

How the locking/burning model reduces dilution

When you burn tokens and lock the resulting vTokens (vBlack in this example), your share of future revenue distributions is preserved and not diluted by new emissions. That’s a critical structural benefit. In volatile markets, dilution can destroy real returns; here, locked burned positions maintain proportional claims to revenue.

Compounding works: if you reinvest weekly distributions back into burning more black tokens (or similar mechanisms), you accelerate the time to breakeven and magnify long-term yield. The math shows compounding can reduce a 9–10 month breakeven period down to about 5 months under current rebate and yield assumptions.

8 — Position sizing, timing, and practical trade ideas

Now that you understand the categories and some specific tokens, here’s how I’m sizing and timing positions as the market gyrates. This is not financial advice — it’s my playbook shared so you can learn to structure your own exposure.

Always start with a core allocation

- Core long BTC and ETH: 40–60% of crypto allocation (split depending on risk tolerance)

- Majors: 20–30% of crypto allocation — Chainlink, BNB, SOL, AVAX, TON

- ETH betas and treasury plays: 10–20% — BMNR and similar

- Yield: 10–20% — revenue-sharing tokens like Black Hole for passive income

Adjust weights depending on your age, risk tolerance, and portfolio goals. If you’re younger and aggressive, tilt more toward ETH betas and yield. If you’re near retirement, favor BTC and yield for cashflow and lower relative volatility.

Use scale-in buying: never all-in at a single price

Scale-in buys reduce the emotional cost of volatility. If you wonder which crypto will explode, realize that the answer often depends on multiple market inflection points; so buying across dips is a sensible approach rather than trying to pick a single bottom.

Exit and risk rules

- Set stop-loss levels for high beta positions. I prefer defined stop exits for smaller-sized speculative positions.

- For core BTC/ETH, use rebalancing and trailing profit-taking rather than hard stop-losses.

- Take profits into fiat or stablecoins systematically as major alts enter euphoric phases.

9 — Scenario planning: short-term and longer term

To answer which crypto will explode, consider three scenarios:

- Fast Easing + BTC leg immediate: Rate cuts and quick BTC re-acceleration lead to ETH breakout → majors → alt mania. ETH betas and yield tokens see outsized returns within months.

- Delayed easing + stair-step market: No big Fed surprise; BTC exhibits stair-step consolidations into 2025–2026. This stretches the bull run and increases total addressable price targets, but the timeline for explosive gains is longer.

- Macro shock / bearish pivot: A shock that re-prices risk could delay everything. In that case, yield strategies preserve capital by providing passive revenue while you wait.

In all cases, the tokens with structural revenue and treasury-driven strategies are well-positioned. That’s why yield and majors are essential complements to core BTC/ETH holdings in a diversified strategy aiming to capture which crypto will explode.

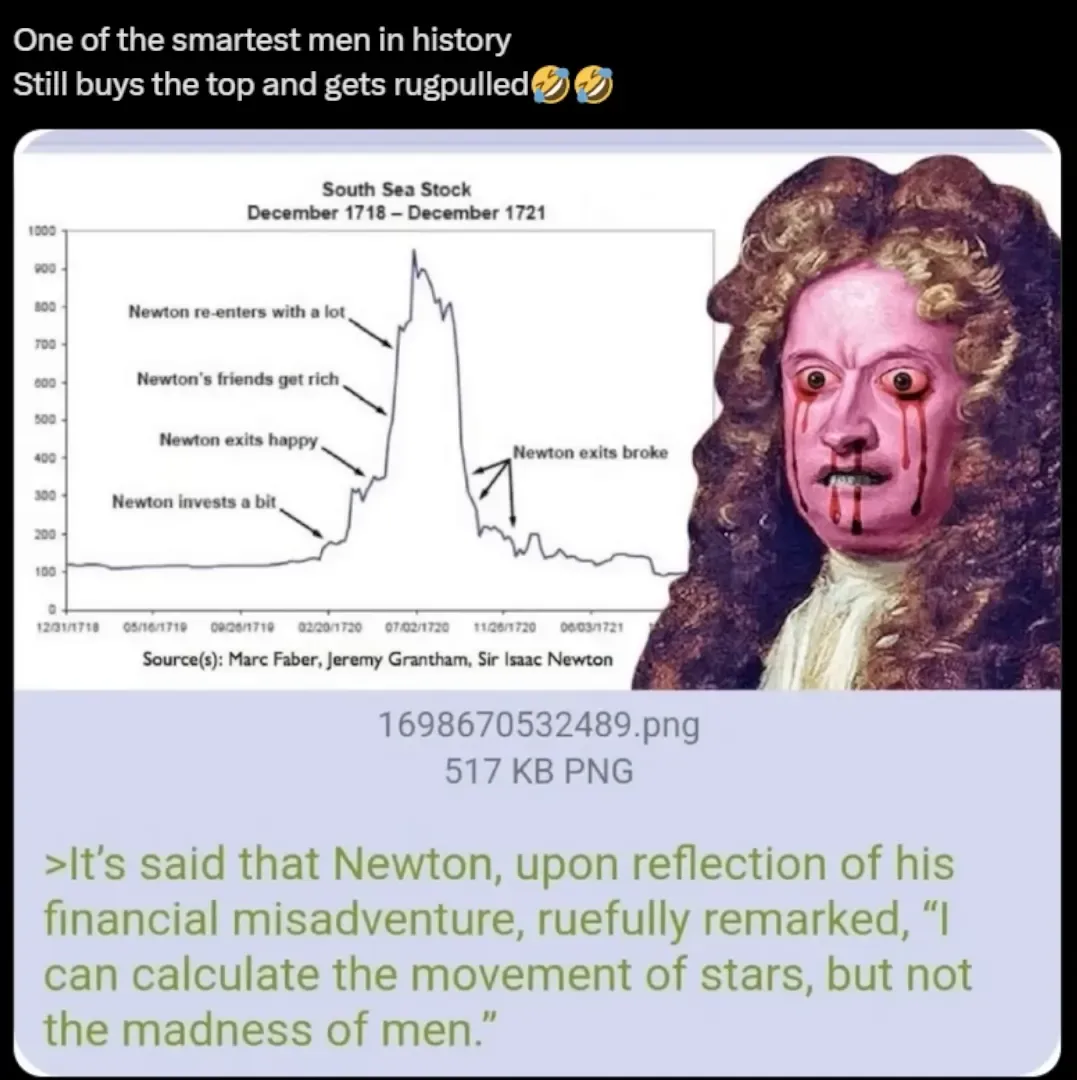

10 — Common mistakes and psychological pitfalls

Isaac Newton’s famous South Sea bubble breakdown is a cautionary tale: even the brightest minds fall prey to FOMO and re-entry at the top. Crypto trading is emotional, and the easiest way to lose is by letting greed or fear dictate re-entries and exits.

Three behavioral rules to apply:

- Have pre-defined position sizes and rebalancing rules.

- Use yield products to reduce the pressure to time the market.

- Document your thesis for each position and revisit it periodically.

11 — Playbook summary: my exact actions right now

Here’s my concise playbook: buy dips in BTC and ETH, accumulate majors on weakness, add ETH betas when they re-enter value zones, and allocate a slice to on-chain yield protocols that distribute real fee revenue. Compound yield distributions back into the protocol where the math supports a fast payback and non-dilutive ownership.

I’m loading up on this dip more aggressively than at any time previously. I’m not immune to risk — crypto can reprice violently — but I believe the upside outweighs the downside here. If you’re asking which crypto will explode, the best answer is: the ones that benefit from institutional flows, protocol revenue, and ETH-led ecosystem growth.

12 — Frequently Asked Questions (FAQ)

Q: Which crypto will explode first if Bitcoin re-accelerates?

A: ETH will likely be the immediate beneficiary after BTC. After ETH moves, majors like Chainlink, BNB, AVAX, and SOL typically follow. ETH betas and treasury vehicles can explode quickly thereafter.

Q: Which crypto will explode in an extended supercycle?

A: In a prolonged cycle into 2026+, expect a broader set of narratives to explode — AI, gaming, NFTs, and riskier alts. Majors and revenue-generating tokens could still outperform in absolute terms due to sustained capital inflows.

Q: Are yield protocols safe if the market crashes?

A: No investment is risk-free. Yield protocols are dependent on on-chain volume and network health. They can provide substantial income in bull markets but can suffer if the underlying chain loses activity. Always size positions according to risk tolerance.

Q: How should I allocate between ETH, majors, and ETH betas?

A: A conservative allocation might be 50% ETH, 30% majors, 20% ETH betas/yield. Aggressive investors can shift toward ETH betas and yield. Adjust based on time horizon and risk profile.

Q: How do I identify which crypto will explode (practical checklist)?

- Does the token benefit from institutional flows or treasury activity?

- Is there a real revenue model or fee distribution?

- Are narratives and on-chain metrics trending positively?

- Is the token in a reasonable value zone after a retracement?

- Do you understand the compounding and dilution mechanics?

Q: What’s the single most important thing to watch next?

A: Watch Bitcoin’s confirmation of another leg higher and Fed rate-cut expectations. Both variables will influence liquidity and the speed at which which crypto will explode.

13 — Final thoughts — the risk/reward and why I’m bullish

Consider these coins as free crypto signals and start making profits. I believe we’re entering a uniquely favorable period in crypto: institutional demand is present but waiting for reasoned regulatory clarity; macro liquidity expectations point to potential easing; and the ecosystem has matured with revenue-generating protocols and treasury-driven assets that can channel institutional capital efficiently. The combination of these forces is why I’m loading up on dips and asking again and again which crypto will explode — because a focused portfolio on ETH, majors, ETH betas, and credible yield can capture massive upside while offering mechanisms to mitigate the emotional costs of trading.

Be mindful: crypto remains high-risk. Positions can reprice 50–80% or more. Size your trades, use compounding where appropriate, and maintain cash or stablecoin dry powder to exploit future dislocations. If you want to participate in the potential upside, structure your portfolio with both conviction in the core (BTC/ETH) and tactical exposure in high-beta opportunities (ETH betas and revenue yield) — that’s my approach, and it answers the fundamental market question: which crypto will explode — the ones with institutional pathways, fee revenue, and scalable adoption.

Stay disciplined, keep learning, and use the seasonal edge of Q4 to your advantage. Good luck, and trade responsibly.