When I saw a post that said, “I’m convinced that 99% of the people on this app have exactly zero idea what a market maker is or does,” it hit a nerve. That line inspired me to break down a deceptively simple question: Who Controls Crypto Prices? The short answer isn’t a single villain or hero — it’s a system of automated liquidity providers, sophisticated trading firms, projects, exchanges, and sometimes regulators. In this article I’ll walk you through what market makers actually do, how deals with token projects are structured, the shady plays some firms use, and how retail traders can defend themselves — plus a few practical tools and services that can help level the playing field.

Table of Contents

- Outline: What we’ll cover

- What is a market maker? The simple explanation

- Why market makers matter — beyond just spreads

- Two common ways token deals with market makers are structured

- Who are the major crypto market makers?

- When liquidity provision looks like manipulation

- Real-world examples and regulatory responses

- So who really controls crypto prices?

- How traders can adapt: tools, bots, and signals

- Ethics, transparency, and what projects should do

- Final thoughts — market makers are both heroes and villains

- Frequently Asked Questions (FAQ)

- Questions I want to hear from you

Outline: What we’ll cover

- What a market maker is — the basic mechanics

- Why market makers matter for crypto liquidity

- Two common token deal structures with market makers

- Who the biggest crypto market makers are (and what they did)

- Shady tactics: stop hunts, spoofing, and liquidity grabs

- Regulatory enforcement and real-world blowups

- How retail traders can use automation and signals

- FAQ: concise answers to the most common questions

What is a market maker? The simple explanation

At its highest level, a market maker is a liquidity provider. Think of landing in Japan with a suitcase full of US dollars. At the currency counter you’ll see a buy rate and a sell rate — that gap in the middle is the spread, and that’s how the counter makes money. In crypto, market makers do the same thing digitally: automated bots post buy and sell orders across exchanges every second of every day.

Who Controls Crypto Prices? Market makers are a big part of the answer because they ensure markets are tradable. Without them, many smaller tokens would suffer huge slippage. A $1,000 buy might move the price 20% or more, making efficient trading impossible.

Not a person in a hoodie

It’s worth repeating: market making is 99.999% automated. These are algorithmic strategies and high-frequency systems, not a shady individual manually smashing buy or sell buttons. That automation is what lets firms provide continuous two-sided liquidity, arbitrage price differences across exchanges, and manage inventory rapidly to keep spreads tight.

Why market makers matter — beyond just spreads

Many people assume market makers only earn money from the spread. That’s true to an extent, but it’s just the tip of the iceberg. Here are additional ways market makers generate returns and influence prices:

- Arbitrage: If Binance prices lag Coinbase, bots buy where it’s cheaper and sell where it’s higher, tightening spreads and normalizing prices.

- Initial market creation: Projects often rely on market makers at token generation events (TGEs) to create the first wave of liquidity and prevent an immediate collapse from airdrop farmers.

- OTC and inventory management: Market makers handle large buys and sells off-exchange and manage inventories that can influence on-exchange depth.

- Strategic project deals: Some market makers take special economics or option-like structures that can create outsized returns if a project succeeds.

Two common ways token deals with market makers are structured

When projects need liquidity, they hire market makers. But these arrangements vary widely. I’ll explain two primary models I’ve seen in the wild.

1) The retainer model — market making as a service

In this model, a project deposits a mix of tokens and cash into an account that the market maker uses strictly for liquidity operations. The market maker is paid a flat fee to manage that pool. The key points:

- The tokens remain the project’s property; the market maker is essentially operating as a hired service.

- If trades are profitable, those gains typically return to the project because it supplied the inventory.

- If the market moves against the positions, the project bears the downside because it supplied the tokens.

This model aligns incentives when a project wants to bootstrap a healthy market without selling large token stakes to liquidity providers.

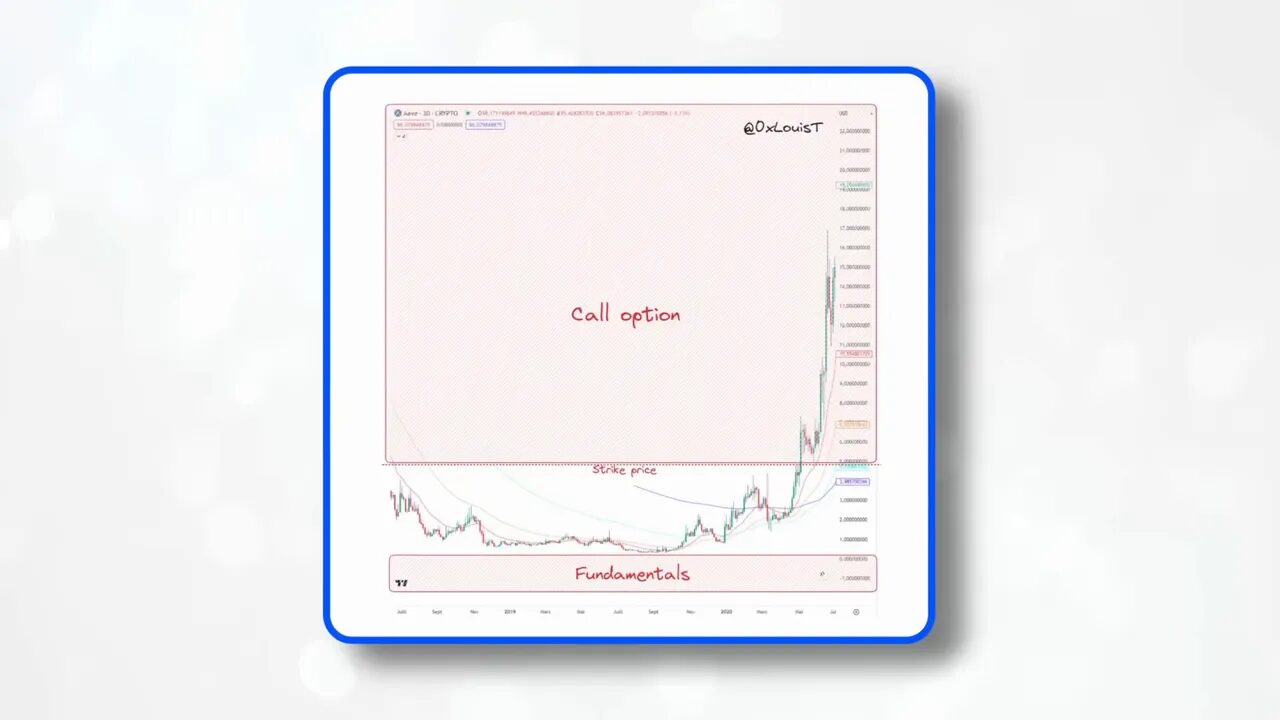

2) The loan + call option model — the spicy one

This structure is more aggressive and can create huge asymmetrical profits for the market maker. Here’s how it commonly works:

- The project loans a small percentage of total supply (often about 1%) to a market maker.

- The market maker supplies stablecoins and liquidity operationally.

- In exchange, the market maker gets a call option to buy those tokens at a fixed strike price at a future date.

That call option can be extremely valuable. Imagine the market maker has the right to buy 1% of supply at a valuation that later grows 20x. A $500K notional can convert into a multi-million-dollar payday overnight. Deals like these have happened — and they’re a major reason why some market making firms have made eye-popping returns.

Who are the major crypto market makers?

In TradFi you’d point to names like Citadel or Jane Street. In crypto, the biggest players are different but just as influential. Here are a few firms you should know about:

Jump (Jump Crypto)

Jump is a Chicago-based high-frequency firm that built a crypto arm in 2021 called Jump Crypto. They were deeply involved in the Terra Luna story, acting as a backer during the UST wobble. In exchange for providing support, Jump reportedly received 65 million LUNA tokens at around $0.40 apiece. When LUNA later spiked above $100, that deal became a multibillion-dollar windfall. But when Terra collapsed, Jump lost billions and faced litigation. The lesson: the same positions that can lead to giant gains can produce devastating losses.

Wintermute

Wintermute is one of the most visible crypto market makers. They’ve moved massive volumes (reports of $34 billion in a single month between them and Binance) and are active across centralized finance (CeFi), DeFi, and OTC markets. Even after a $160 million hack in 2022, they doubled down and expanded their liquidity footprint.

DWF Labs

DWF Labs is a chameleon. In just a few years they invested in over 400 projects, acting as a liquidity provider, VC, and growth partner. That means sometimes they’re offering helpful seed liquidity and support, and other times their activity can feel like they’re steering narratives to boost token performance. Their multi-role approach is why opinions about them are split.

When liquidity provision looks like manipulation

Just because market makers are supposed to be neutral liquidity providers doesn’t mean they always act benignly. Several tactics used by market makers and high-frequency trading firms blur the line between legitimate liquidity and market manipulation. Let’s walk through the more common shenanigans.

Liquidity grabs and stop hunts

Market makers can often infer where retail traders place stop losses — those clustered orders show up as thin areas in the order book. A common tactic is to nudge the price just enough to trigger those stops and liquidations, scoop up tokens at the discounted price, and then push the price back up. This “stop hunt” or liquidity grab extracts value from shorter-term traders and redistributes it to the liquidity provider’s inventory.

Spoofing and fake walls

Spoofing involves placing large buy or sell orders to create the impression of depth, enticing traders to act, and then canceling those orders before they’re filled. The result: retail traders can be lured into poor entries, thinking momentum is building when it isn’t. Spoofing is illegal in regulated markets and is increasingly subject to scrutiny in crypto as regulators pursue bad actors.

Fakeouts, FOMO, and psychological plays

Market makers and algos can create sudden wick-like moves to trigger panic or FOMO (fear of missing out). That could be a sharp spike that reverses, leaving late buyers stopped out, or a pre-news pump where liquidity providers front-run or exploit timing around announcements. These moves are deliberately psychological — they’re meant to manipulate sentiment and herd behavior.

Real-world examples and regulatory responses

These behaviors aren’t just theory. There have been concrete blowups and legal actions that make it clear some firms crossed the line.

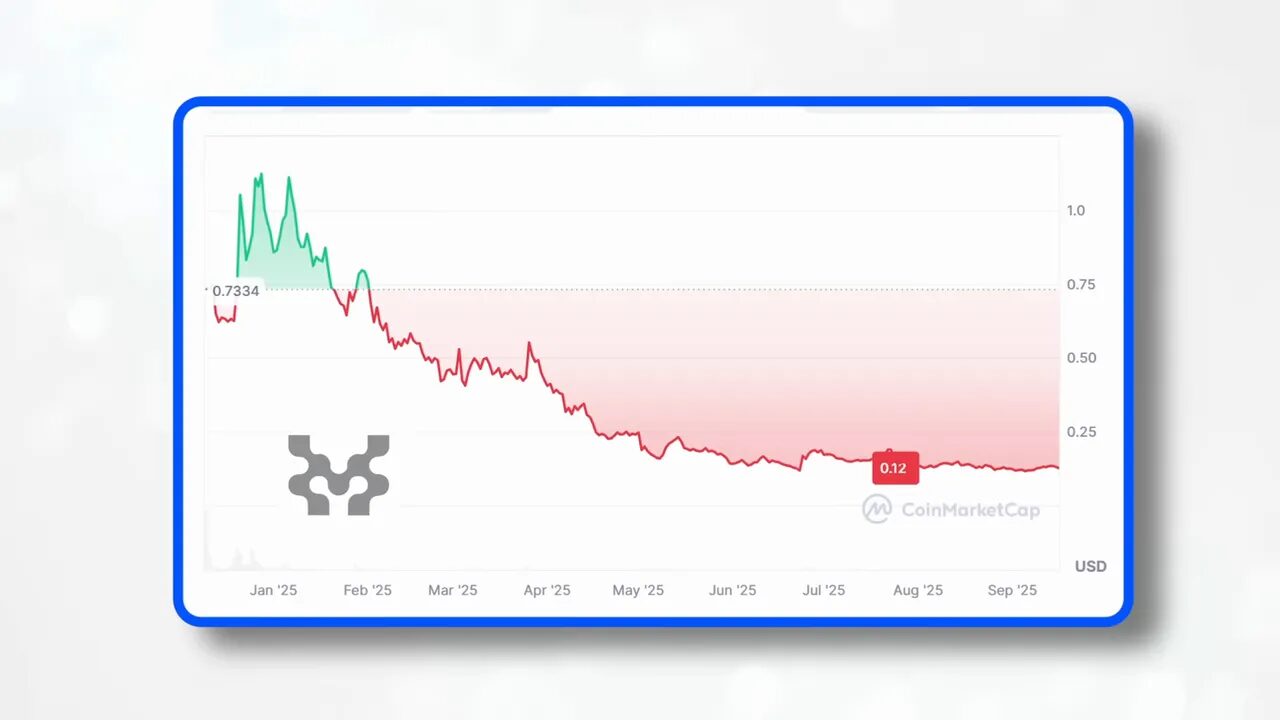

The $38 million dump

In one notable case, a market maker dumped $38 million worth of tokens shortly after a launch, causing the price to crash 30% in a single day and 86% over time. That crash wiped out retail participants and is a textbook example of why token economics and market maker incentives must be transparently aligned with project health.

SEC enforcement: manipulation as a service

The SEC and other regulators have levied charges against firms accused of “manipulation as a service.” Firms such as ZM Quant, Gotbit, and CLS Global were accused of running bots capable of generating quadrillions of trades and billions in fake volume daily. Those activities made projects appear alive when they weren’t, misleading retail investors and exchanges about genuine market interest.

Regulatory scrutiny is increasing. While crypto markets can still be fragmented and lightly regulated in many jurisdictions, enforcement actions demonstrate authorities are paying attention to automated market abuse.

So who really controls crypto prices?

Who Controls Crypto Prices? The answer is multifaceted:

- Market makers and HFT desks provide continuous liquidity and can influence short-term price action through algorithmic strategies.

- Token projects and early backers shape supply dynamics and can shift prices through token releases or strategic deals.

- Exchanges and their internal trading arms sometimes add another layer of activity that affects order books.

- Whales, large traders, and coordinated groups can move markets, especially where liquidity is thin.

- Retail sentiment and social narratives still matter: coordinated buying or selling driven by social media, FOMO, or panic can move prices significantly.

In short: no single actor has absolute control. Market makers are powerful and often implicated when prices move quickly, but they operate within an ecosystem of incentives, counterparties, and market structure. That ambiguity is why the question “Who Controls Crypto Prices” is so sticky — the control is distributed, and the appearance of manipulation can come from legitimate, profitable market making strategies as well as from outright abuse.

How traders can adapt: tools, bots, and signals

If market makers and algos dominate short-term price moves, what can a retail trader do? A few practical measures can help:

- Use automation: Market making is automated — retail traders can also leverage bots to execute grid strategies, dollar-cost averaging, and rule-based exits. Platforms like Three Commas offer highly customizable bots that can execute strategies based on TradingView signals, grid buys during sideways markets, and backtesting to validate ideas.

- Manage risk: Smaller position sizes, wider stop distances in noisy markets, and avoiding crowded liquidity pockets around predictable stops reduces vulnerability to stop hunts.

- Study the order book: Recognize fake walls and abnormal volume spikes. If a breakout is accompanied by suspicious volume patterns, be cautious.

- Use high-quality signals: For scalpers hunting micro-moves, having access to timely, reliable signals can be the difference between being hunted and hunting. That’s where services like Best Crypto Trading Signals can help — they provide scalping signals tailored for high-frequency opportunities, helping traders identify short-duration setups while managing risk.

Automation isn’t just for institutions. Using bots and signal services allows retail to execute disciplined strategies and react faster than manual trading alone.

Note: integration of automated tools should be done with conservative sizing and proper backtesting. If you’re exploring automated strategies, test them against historical data, simulate them live with small capital, and treat them as another part of your risk management toolkit — not a get-rich-quick switch.

Ethics, transparency, and what projects should do

Projects that partner with market makers should make the economics of the arrangement transparent. Retainer agreements, inventory ownership, and call option structures change incentives — and investors deserve to know if a firm has the right to buy tokens at a deep discount in the future. Transparency helps align interests and reduces the potential for abuse.

Who Controls Crypto Prices? Ultimately, market health is a shared responsibility. Projects, market makers, exchanges, and regulators all play roles. Projects should prioritize responsible token release schedules, choose reputable liquidity partners, and disclose material arrangements. Exchanges should police bad actor behavior like spoofing. Regulators should focus on pattern-based abuses that hurt retail investors.

Final thoughts — market makers are both heroes and villains

Market makers bring order to otherwise chaotic markets. Without them, many tokens would be nearly untradeable, launches would fail to attract sustainable liquidity, and price discovery would be poor. But market makers can also have asymmetric incentives that lead to harmful behaviors — especially in token deals with opaque terms.

So when you ask, “Who Controls Crypto Prices?” the answer is nuanced. Market makers are a central piece of the puzzle, but they are neither omnipotent nor uniformly benevolent. Long-term investors are generally unaffected by normal market making. Short-term traders, scalpers, and momentum players are the ones who most often feel market makers’ fingerprints — whether in the form of aggressive fills, stop hunts, or sometimes outright abuse.

If this has changed how you see price action, start by improving how you interact with the market: use automation and signals, manage position sizing, and hold projects accountable for transparency. And if you’re serious about short-term opportunities, consider tools and services that help you act with speed and discipline — for example, Best Crypto Trading Signals for scalping ideas and reputable bot platforms for disciplined execution.

Frequently Asked Questions (FAQ)

Who controls crypto prices — is it just market makers?

Not just market makers. Market makers are a major player in short-term liquidity and price formation, but exchanges, whales, project tokenomics, regulatory news, and retail sentiment all contribute. The control is distributed across multiple actors.

Are market makers always bad?

No. Market makers provide essential liquidity that keeps markets tradable and limits slippage. Problems arise when incentives are misaligned or when firms use deceptive tactics like spoofing, liquidity grabs, or wash trading.

How can retail traders avoid being stop-hunted?

Avoid clustering your stops at obvious price levels, use smaller sizes, consider conditional orders with discretion, and rely on broader risk management strategies. Watching order book dynamics and avoiding trading directly into thin liquidity can also help.

Can I use bots like market makers do?

Yes. Platforms allow retail traders to run grid strategies, DCA, and signal-based automation. Backtest thoroughly and start with small capital. Automation helps maintain discipline and can execute faster than manual trading.

What is the difference between a retainer model and a loan + call option model?

In the retainer model, the project provides tokens and cash for the market maker to manage, and the market maker is paid a fee. The project retains inventory risk. In the loan + call option model, the market maker gets the right to buy tokens at a fixed price later — potentially a very lucrative option if the token price explodes.

How do regulators view market makers in crypto?

Regulators are increasingly scrutinizing manipulative behaviors like spoofing and fabricated volume. The SEC and other agencies have taken action against firms accused of “manipulation as a service” when bots were used to simulate activity and mislead investors.

Where can I learn more about combining signals with automation?

Look for services that offer both real-time scalping signals and the ability to integrate signals with execution platforms or bots. Start by backtesting, then move to small live allocations. For scalpers seeking actionable setups, Best Crypto Trading Signals provides tailored scalping alerts that can be paired with bot execution for faster reaction times.

Questions I want to hear from you

Now that we’ve pulled back the curtain on market makers, I’d love to know your take: has this changed how you answer the question “Who Controls Crypto Prices”? Do you view market makers as essential infrastructure or a system that needs stricter rules? Drop your thoughts below — it’s one of the best ways we all get smarter.