Table of Contents

- What this guide covers

- How price actually moves (and why retracements are predictable)

- Fibonacci settings and the golden zone

- Where to anchor your Fibonacci: use fractals to remove guesswork

- Confluence is everything: retests, 200 EMA, and anchored VWAP

- Putting the setup together — a complete example

- Trade management: entries, stop loss, and take profit

- Applying this method to crypto and where crypto trading signals help

- Comparing with supply and demand

- Which Fibonacci levels should I include for this strategy?

- What time frames work best for the golden zone strategy?

- How do I pick the correct start and end points for Fibonacci?

- Where should I place stop loss and take profit?

- Can I use this strategy on crypto markets?

- How important are confluences?

What this guide covers

- Why Fibonacci retracement works and what the “golden zone” is

- Exact TradingView settings to use

- How to choose the correct start and end points using fractals

- Layering confluence: retests, 200 EMA, and anchored VWAP

- Step-by-step trade setup, risk placement, and targets

- How to apply this across markets, including crypto — and a subtle way to scale with crypto trading signals

How price actually moves (and why retracements are predictable)

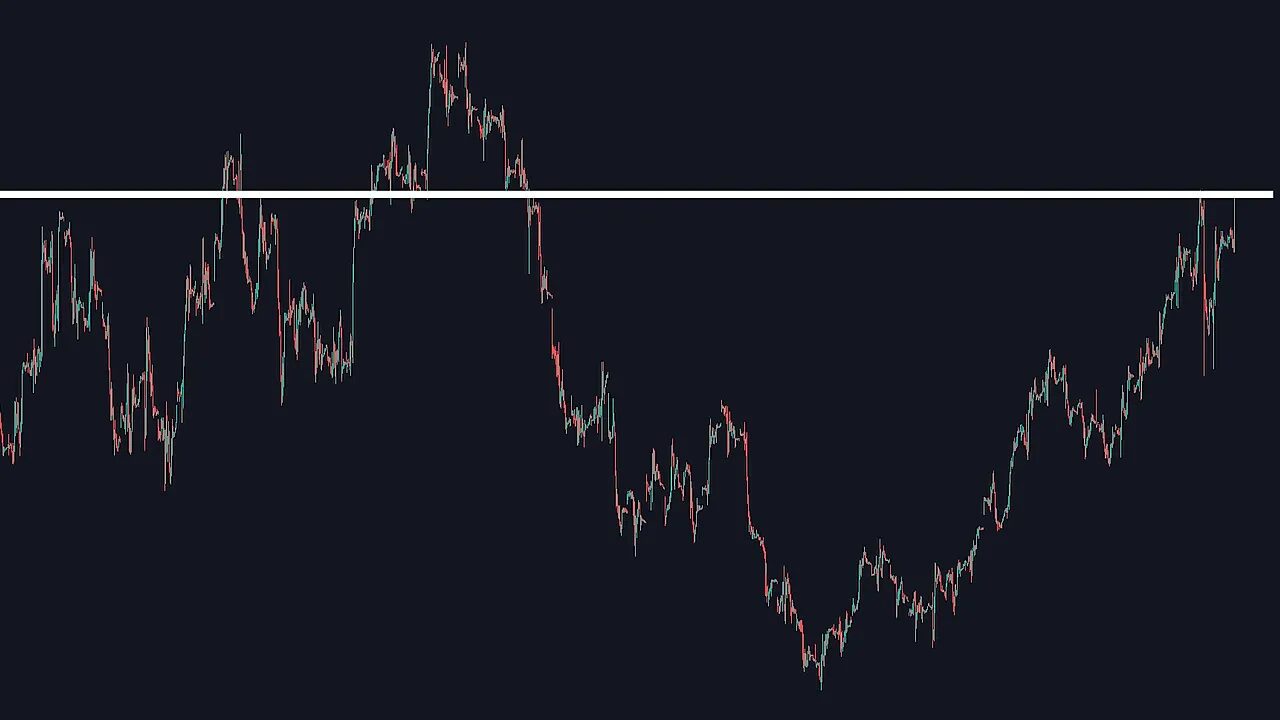

Markets rarely move in a straight line. They trend, then they pull back, then they resume the trend. That pullback is your opportunity.

The aim with Fibonacci retracement is simple: predict where the pullback will end so you can take a low-risk, high-reward entry near the end of the retrace and ride the next leg of the trend.

Fibonacci settings and the golden zone

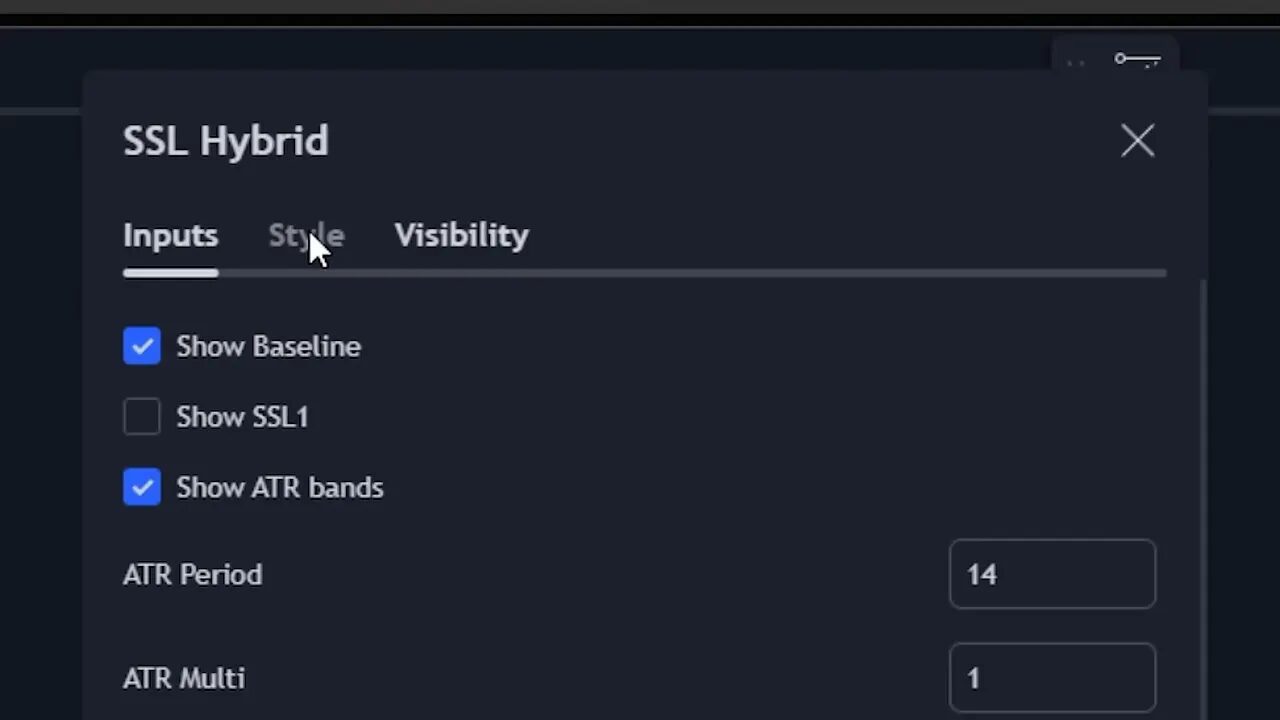

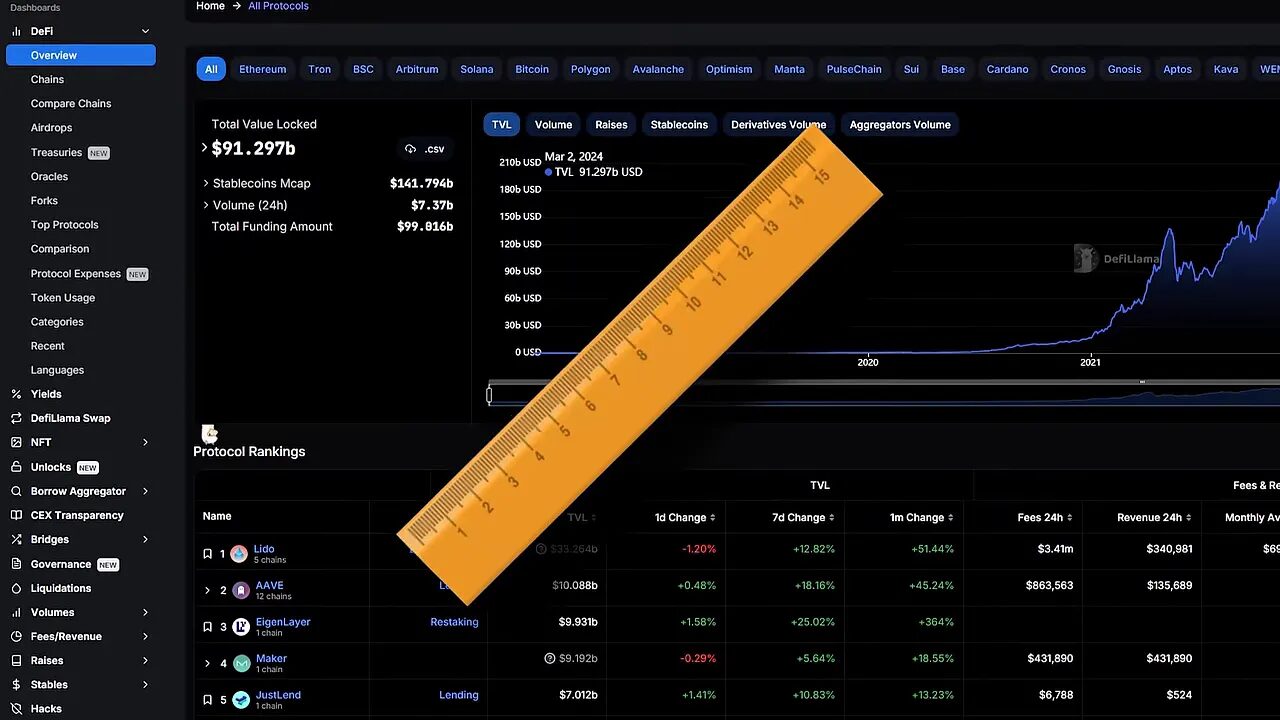

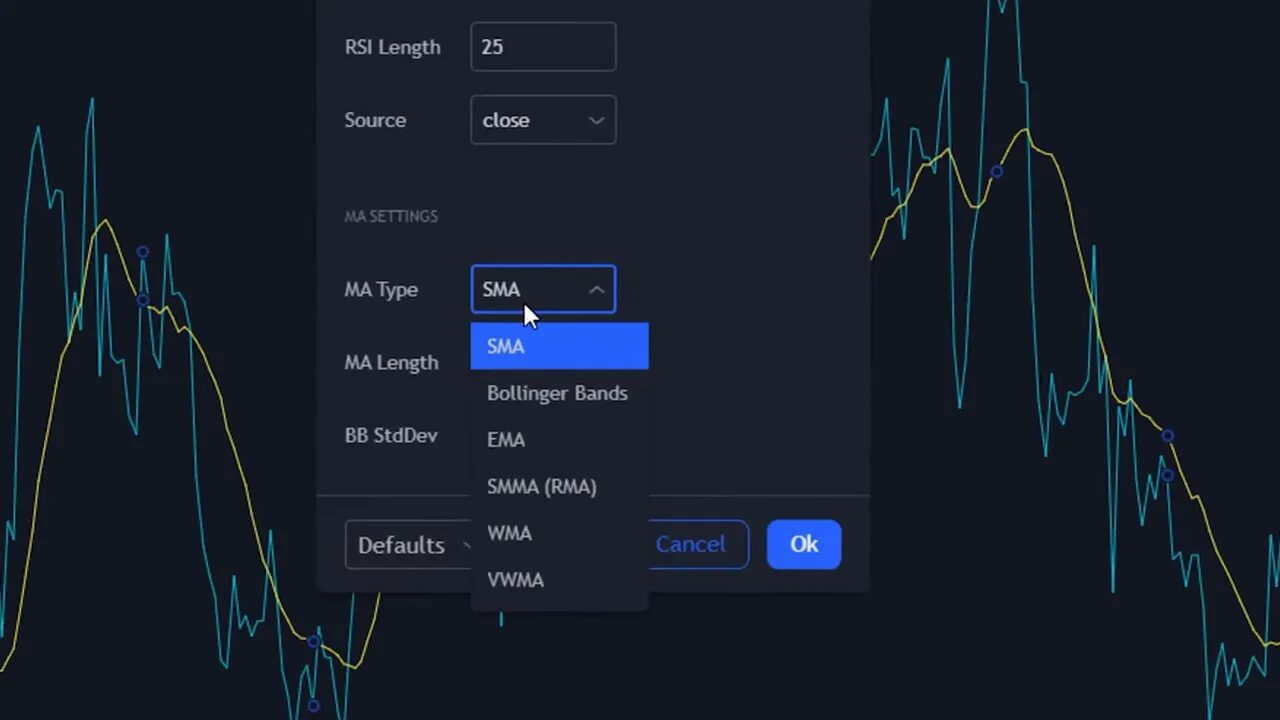

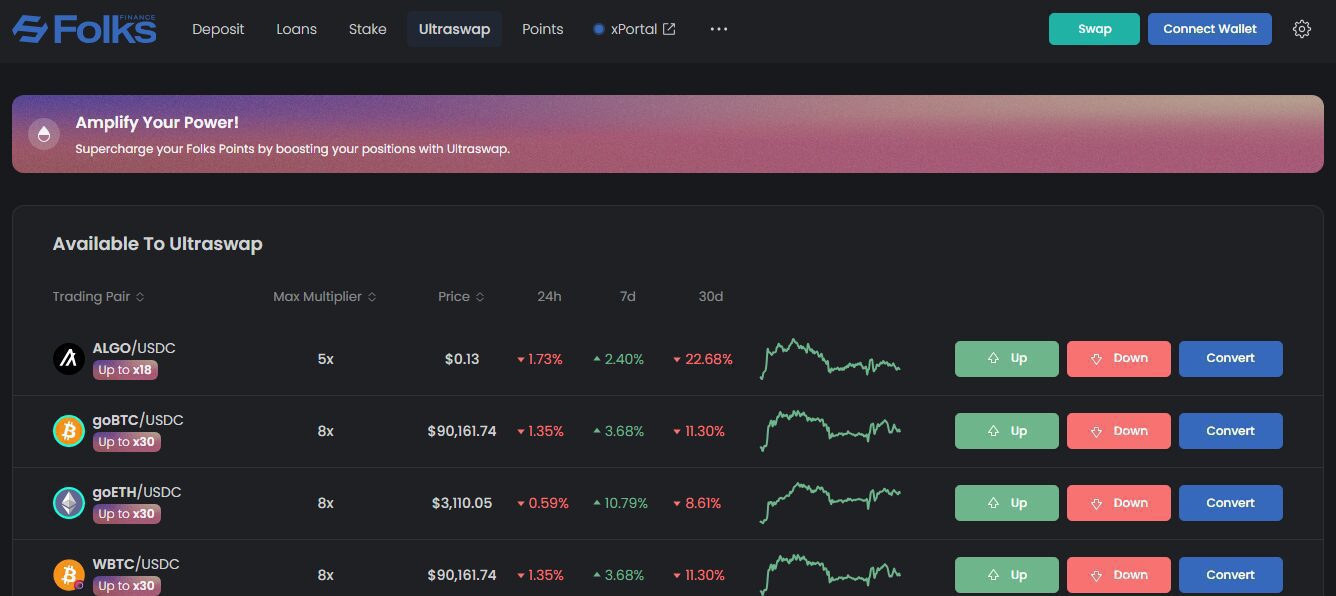

Not all Fibonacci levels are equal for every strategy. For this approach I use the following levels in TradingView: 0, 0.382, 0.5, 0.618, 1. The area between 0.382 and 0.618 is what I call the golden zone. That is the most likely region for a high-probability retracement reversal.

These three levels give a clear “zone” rather than a single line. Treat the golden zone as a target area to wait for additional confirmation instead of mechanically entering the instant price touches a single level.

Where to anchor your Fibonacci: use fractals to remove guesswork

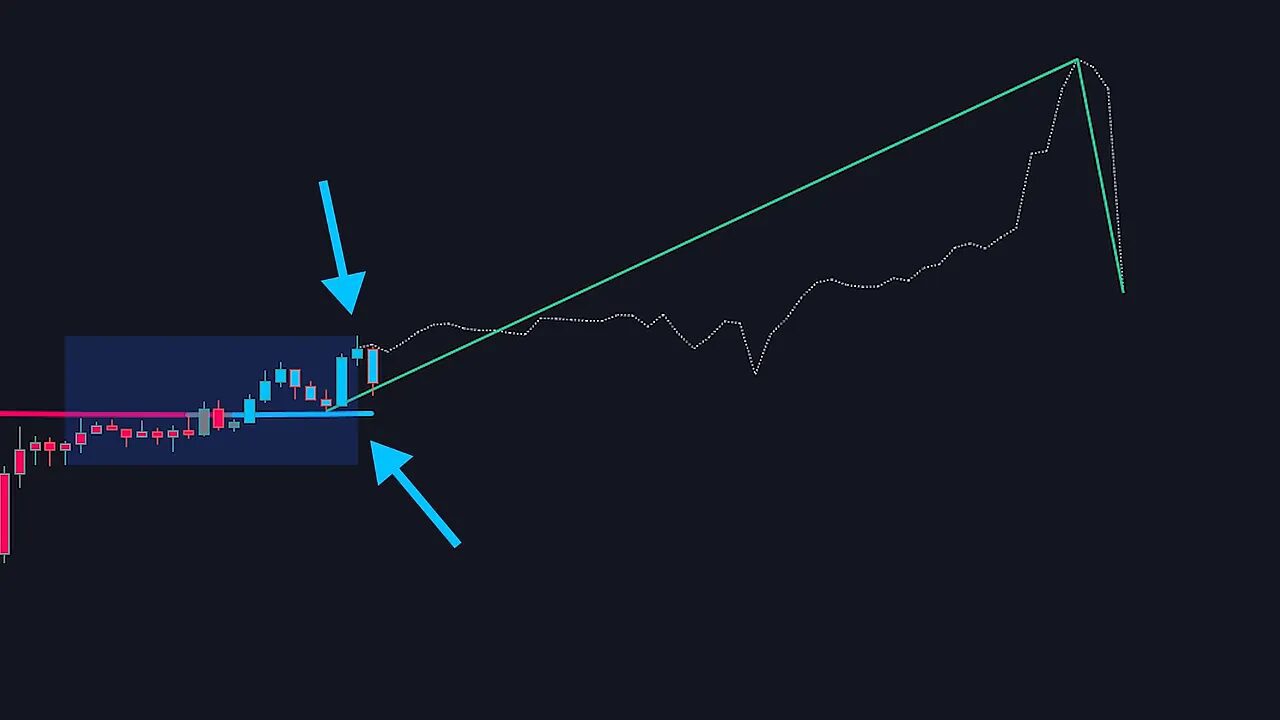

One of the most common errors is placing the Fibonacci start and end on weak swings. Use the fractals indicator to filter for strong swings so you anchor the tool only on meaningful moves.

Set the fractals indicator period to 10 to reduce noise. That gives you fewer, stronger swing points to choose from. Then mark the Fibonacci from the significant low (red fractal) to the significant high (green fractal) for an uptrend, and vice versa for a downtrend.

Only apply this method to strong, clean trends. If swing points are bunched up or the move looks choppy, skip it. The Fibonacci tool performs best on clear, impulsive moves.

Confluence is everything: retests, 200 EMA, and anchored VWAP

Fibonacci on its own works, but when paired with other confirmations the signal becomes far more reliable. Add these three confluences to stack probability in your favor.

1) Support and resistance retests

When price breaks through a resistance and then retests it as support at the golden zone, that retest provides a strong reason to expect a bounce. Always zoom in to check whether the broken level aligns with the Fibonacci golden zone.

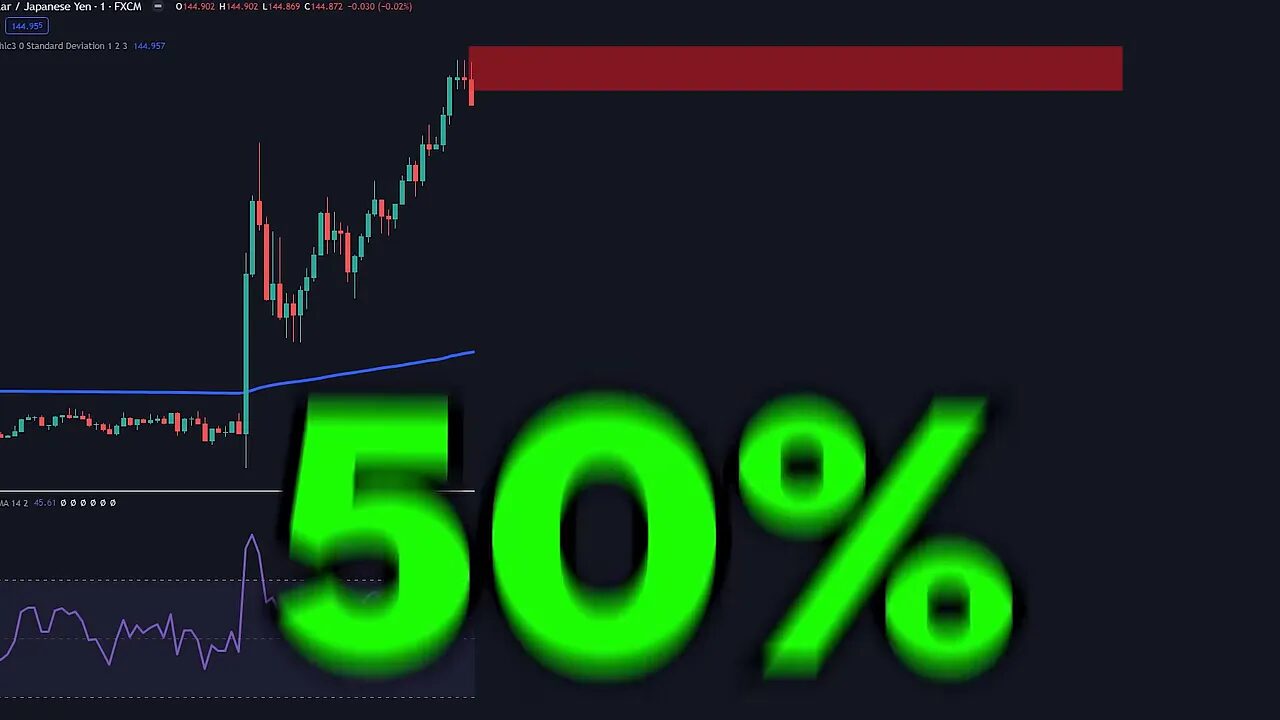

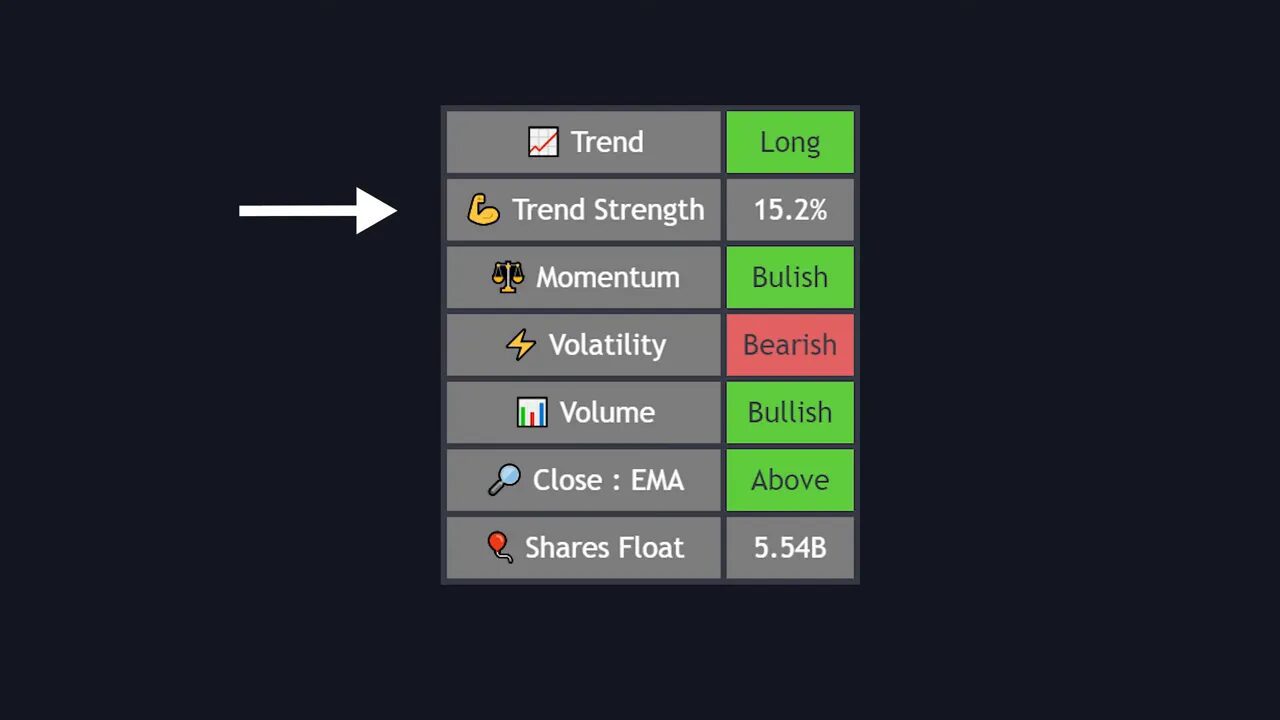

2) 200 EMA as a trend filter and dynamic support/resistance

The 200 exponential moving average is a heavy-weight tool on higher time frames. On 1-hour and 4-hour charts it frequently acts as a reliable support or resistance. If the 200 EMA sits inside the golden zone, that is a high-value confluence.

Use the EMA to confirm trend direction: price above the 200 EMA generally favors long entries, price below favors shorts.

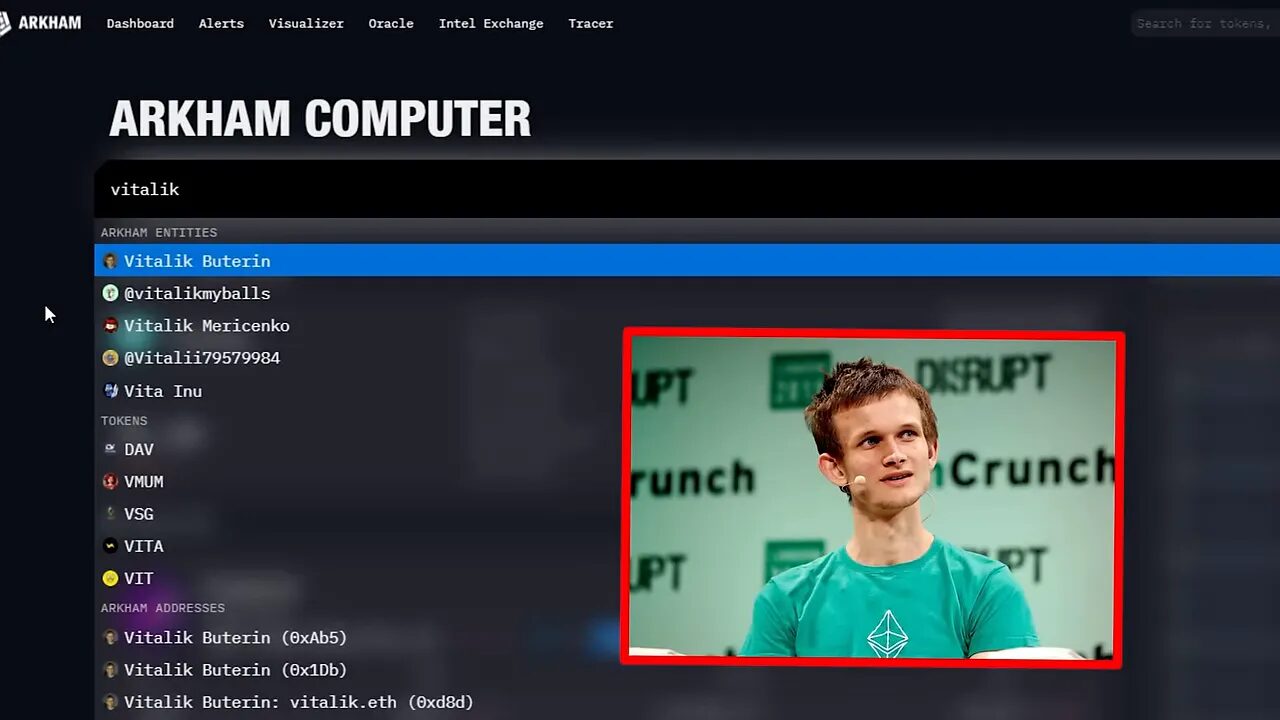

3) Anchored VWAP for institutional reference

Anchored VWAP acts like a value line you choose yourself. Anchor it to the beginning of the strong move (the same red fractal you used for Fibonacci). If the anchored VWAP lies inside the golden zone, you have another independent source expecting price to find value there.

Turn off all anchored VWAP extras and keep the VWAP line only. It behaves similarly to the EMA but is derived from volume-weighted price — useful to see where buyers and sellers have concentrated value.

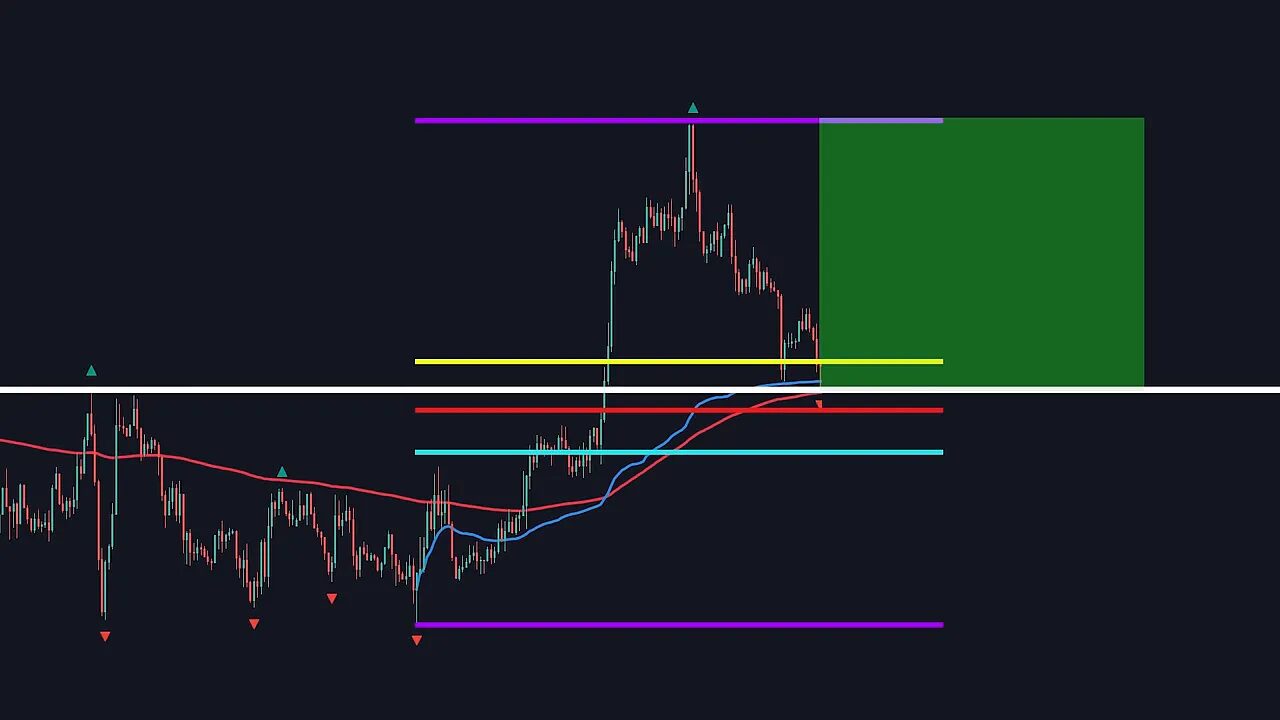

Putting the setup together — a complete example

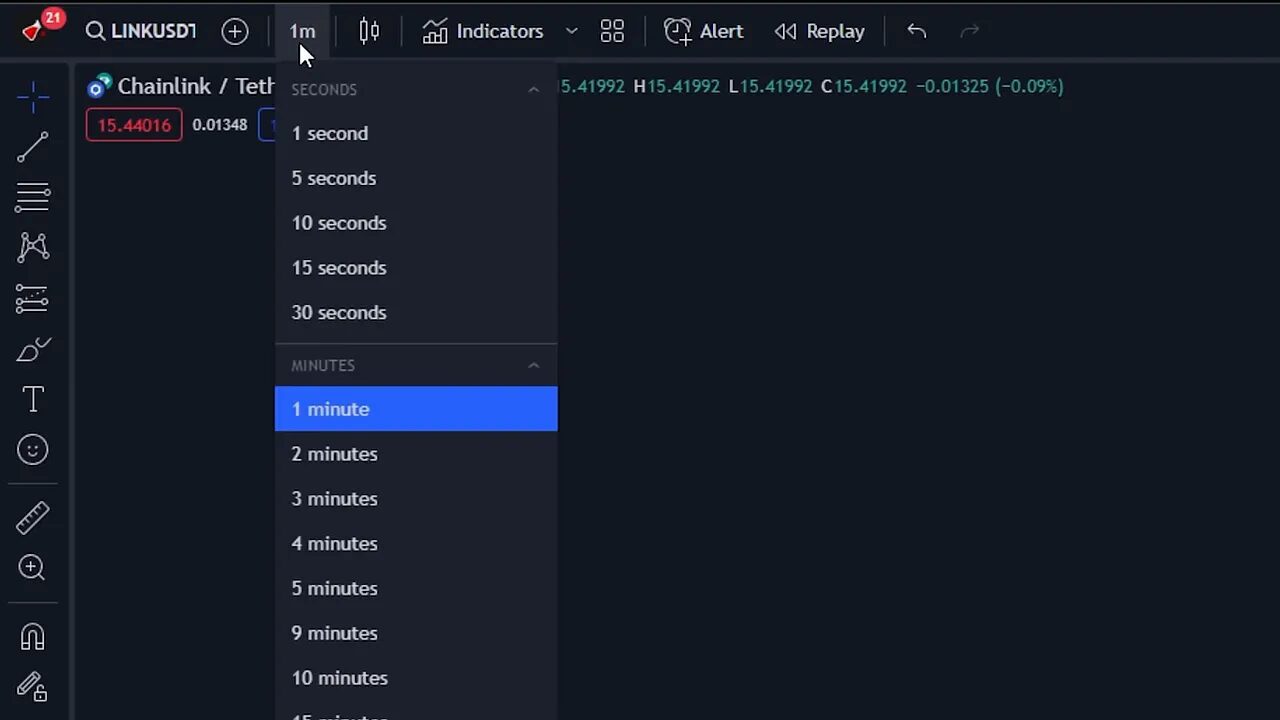

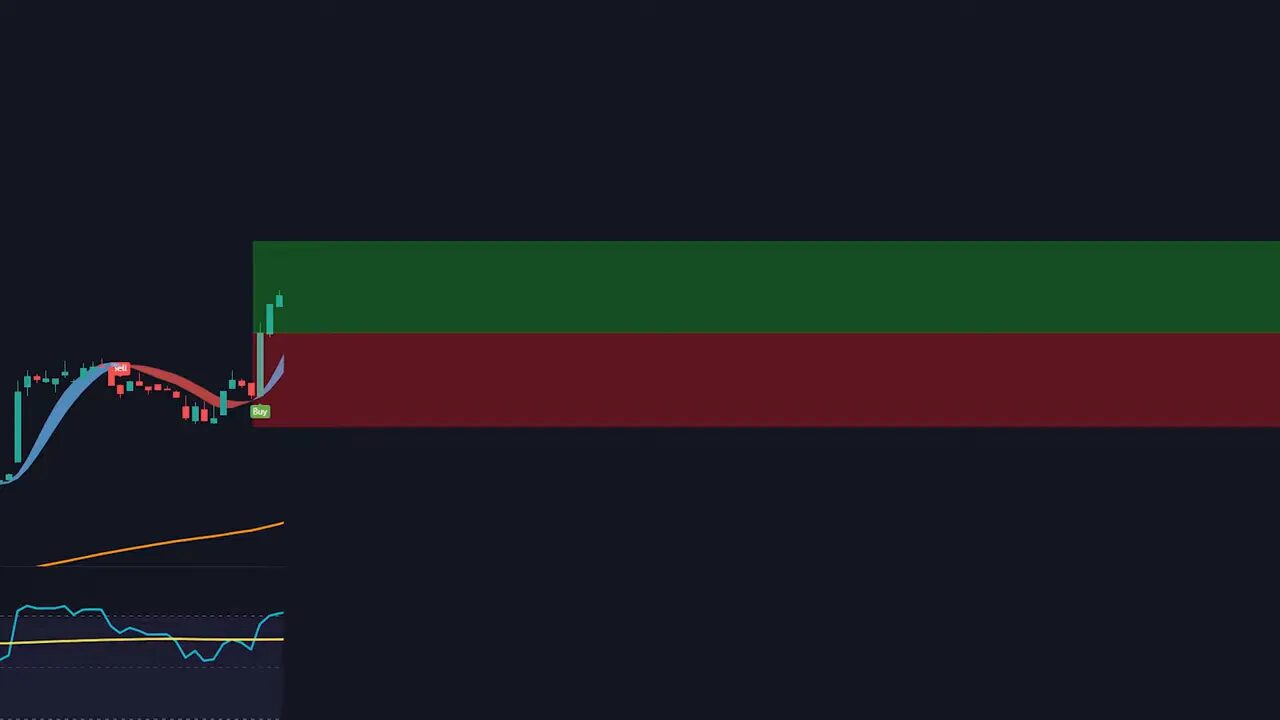

Preferred time frames: 1-hour and 4-hour. For reliability, I favor the 4-hour.

- Identify a strong impulsive move and confirm it with a high fractal and a low fractal (period = 10).

- Draw Fibonacci from the swing low to the swing high. Note the golden zone between 0.382 and 0.618.

- Look for a prior horizontal resistance that price broke and could now retest as support inside that golden zone.

- Add the 200 EMA. Confirm it is inside the golden zone or nearby.

- Anchor VWAP at the start of the move. Confirm the anchored VWAP sits in the golden zone too.

When all four confluences line up — golden zone, retest level, 200 EMA, and anchored VWAP — the probability of a clean bounce is high. I usually place take profit at the high of the impulse move and stop loss just below the golden zone.

Trade management: entries, stop loss, and take profit

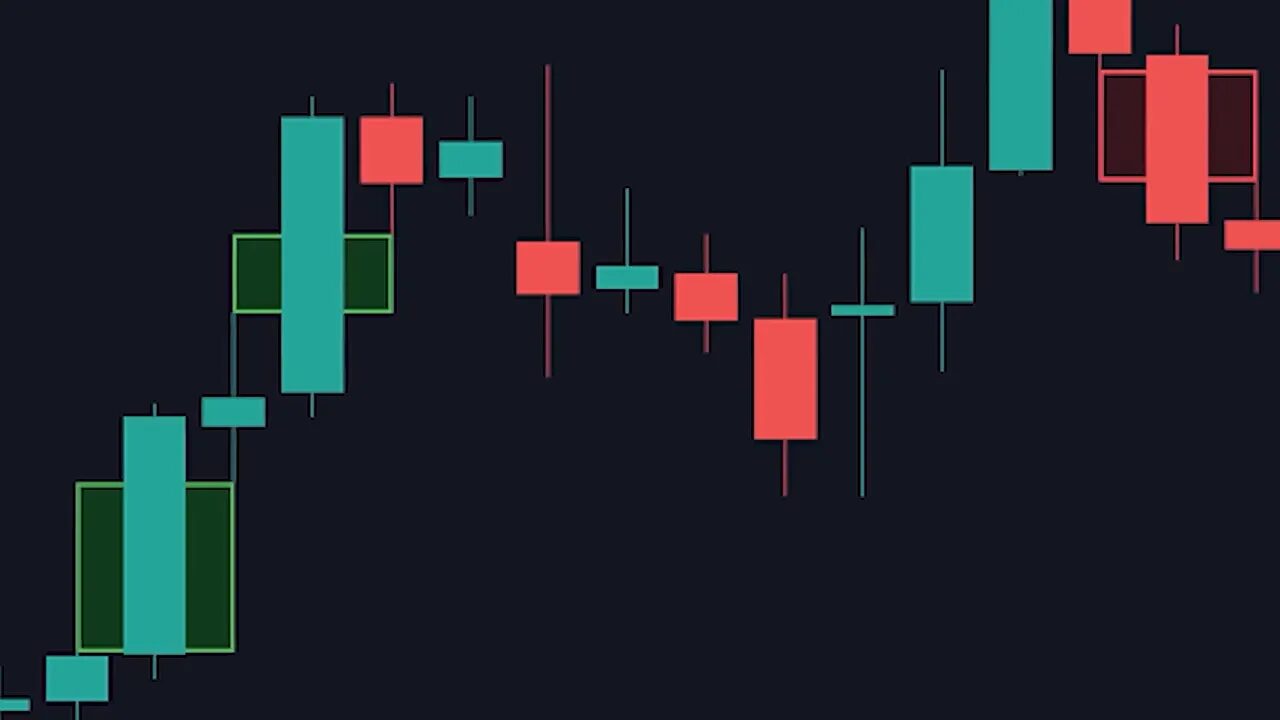

Entry: wait for price action confirmation within the golden zone. That can be a bullish engulfing candle, pin bar, or a clear rejection wick.

Stop loss: place it conservatively just below the golden zone. This keeps risk tight while allowing normal wick action.

Take profit: target the swing high from which the Fibonacci was drawn. You can scale out partials or trail with a moving average depending on your style.

Applying this method to crypto and where crypto trading signals help

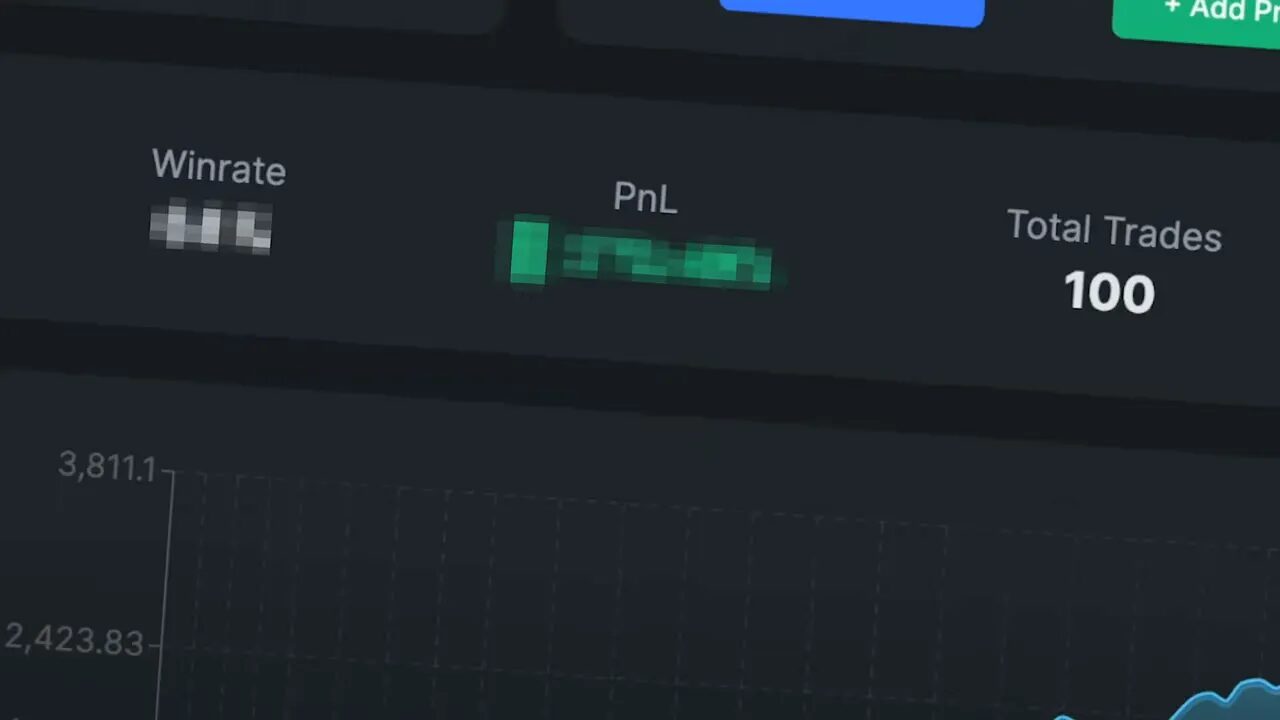

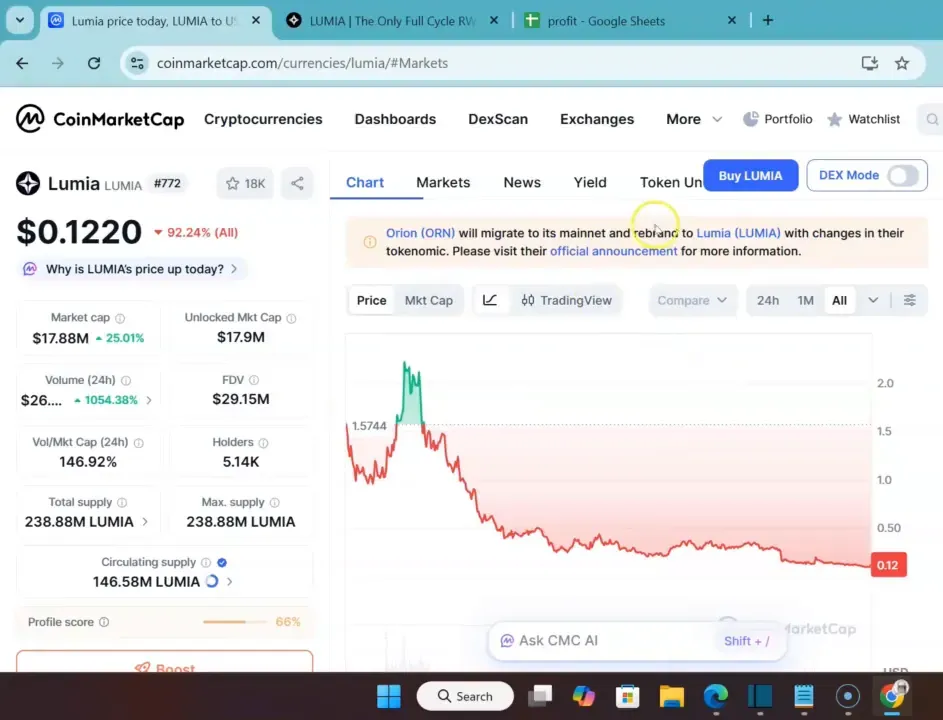

This technique translates well to crypto markets, but crypto can be noisier and influenced by different liquidity patterns. On longer time frames, the same rules apply: strong impulsive moves, a clean retrace into the golden zone, and multiple confluences.

For traders who want to apply this across many coins or blockchains, curated crypto trading signals can be a practical complement. Signals that highlight high-volume impulsive moves or mark where value is accumulating let you quickly focus on coins where a Fibonacci golden zone setup might form. Use signals to pre-filter opportunities, then apply the fractal + Fibonacci + EMA + anchored VWAP checklist to take precise entries.

Comparing with supply and demand

Supply and demand zones map nicely to the Fibonacci golden zone concept. A demand zone that happens to fall inside the golden zone is a powerful double confirmation. Conversely, if a supply zone lines up with the golden zone in a downtrend, that strengthens a short setup.

Use the same confluence rules: strong impulse move, clear retrace, and overlapping structural levels.

Which Fibonacci levels should I include for this strategy?

Include 0, 0.382, 0.5, 0.618, and 1. The area between 0.382 and 0.618 is the golden zone and should be treated as your primary retracement target.

What time frames work best for the golden zone strategy?

Higher time frames, such as the 1-hour and 4-hour, produce more reliable signals. The 4-hour is preferred for cleaner, less noisy setups.

How do I pick the correct start and end points for Fibonacci?

Use the fractals indicator set to period 10 to filter for major swing points. Anchor Fibonacci from the confirmed swing low to swing high for uptrends (and vice versa for downtrends).

Where should I place stop loss and take profit?

Stop loss goes just below the golden zone. Take profit is commonly set at the swing high of the impulse move. Adjust size and targets according to your risk management rules.

Can I use this strategy on crypto markets?

Yes. Crypto can be noisier, so stick to higher time frames and favor coins with good liquidity. Using curated crypto trading signals to pre-filter impulsive moves can save time and improve idea quality.

How important are confluences?

Confluences are critical. The Fibonacci golden zone is a powerful base, but stacking it with retests, a 200 EMA, and an anchored VWAP dramatically increases probability and improves entry precision.