2025 was a wild year for markets. US stocks were up roughly 16 percent, international stocks surged nearly 30 percent, gold climbed around 70 percent, and silver exploded by about 150 percent. Crypto did not get the memo: the broad market fell roughly 10 percent. Those results raise a blunt question: is there any point to holding crypto in 2026, and if so, what should a thoughtful crypto portfolio look like?

This guide walks through the structural forces that shaped last year, why those forces matter for crypto in 2026, and practical portfolio frameworks you can use depending on your risk tolerance and time horizon. The logic is simple: follow liquidity, understand regional investor preferences and regulation, and align holdings to the niches most likely to capture that liquidity.

Note: I am not a financial advisor. This is educational content to help you understand market mechanics and potential strategies. Use this as a framework, not as financial advice.

Table of Contents

- The Big Picture: 2025’s Liquidity Detour

- Assets Live on a Risk Spectrum

- How International Flows Can Eventually Boost Crypto

- Regional Flows: Europe, South Korea, Canada — and What They Mean

- Two Crypto Niches to Watch in 2026: Stablecoins and Tokenized Assets

- What the Ratios Tell Us — and What They Don’t

- Is Ethereum the Better Anchor in 2026?

- Stablecoins or Cash-Like Positioning as a Defensive Play

- Tokenized Gold (and Other Tokenized Commodities)

- Constructing an Optimized Crypto Portfolio for 2026

- Practical Considerations and Execution

- Trading Opportunities and Tools

- Timing: When Will International Liquidity Flow into Crypto?

- Do Stocks Like Circle or Coinbase Provide a Bridge?

- Checklist Before You Make Any Allocation

- Signals, Research, and Execution — A Final Word

- Timeline Summary

- Frequently Asked Questions

- Final Thoughts

The Big Picture: 2025’s Liquidity Detour

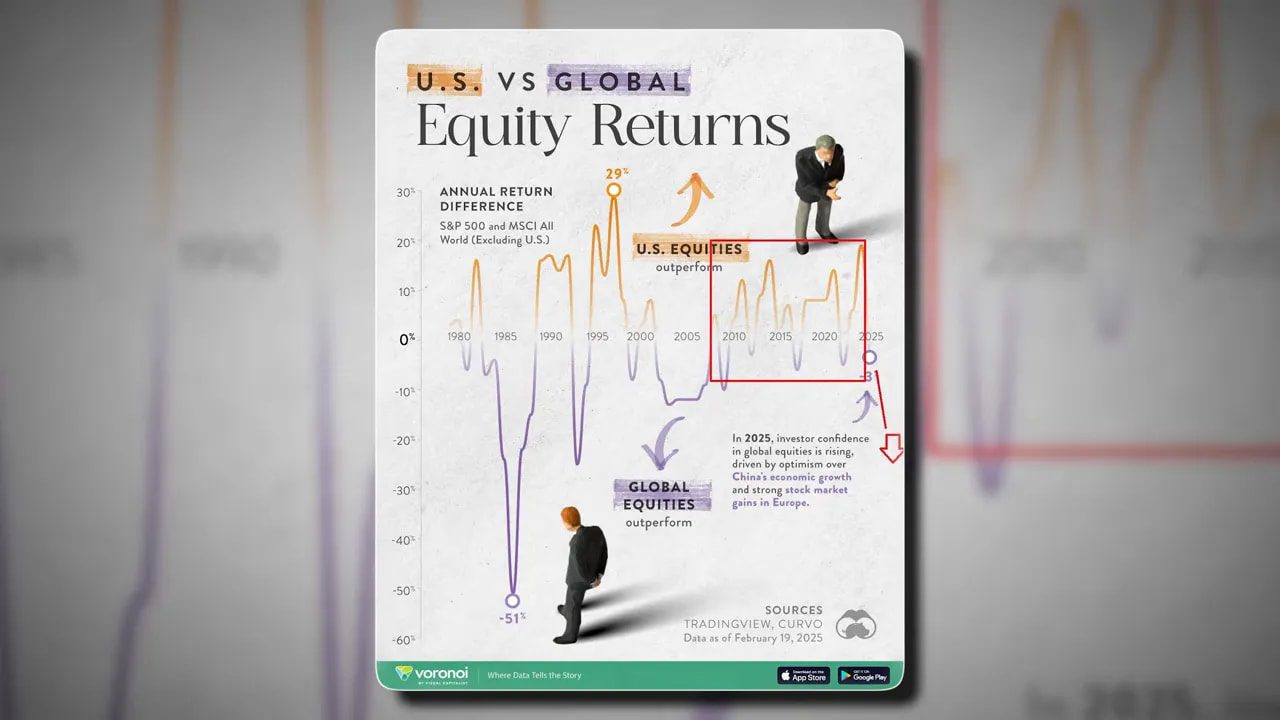

Markets move in cycles and capital flows. In 2025 we saw a striking rotation: capital moved out of the US and into international markets and commodities. The US dollar fell by almost 10 percent, political uncertainties around tariffs and alliances created doubts about the US as the unquestioned center of global investment, and that helped fuel interest in international equities and hard assets.

Why does this matter for crypto? Because when institutions and big pools of capital increase risk appetite, they do not allocate randomly. They allocate along a spectrum of perceived risk and accessibility. In previous cycles, that risk-on energy often found its way into crypto and US small-cap stocks. In 2025, much of that risk-on capital took a detour overseas instead of online. The consequence: crypto lagged, while many international equities and precious metals outperformed.

Assets Live on a Risk Spectrum

Think of all investable assets as positioned on a spectrum from low risk to high risk. At one end you have government bonds and reserve assets; at the other you have small-cap speculative equities and crypto. As investor confidence rises, capital moves further out along this spectrum.

But the key nuance is this: the specific assets that capture that capital depend on regional perception of what’s “safe” and what’s “risky,” as well as on ease of access and regulation. After Russia’s central bank reserves were frozen in 2022, several countries increased gold reserves rather than holding Western government bonds. That resulted in outsized flows into gold within the “safer” segment. On the riskier end, institutional capital in 2025 appears to have favored foreign equities and commodities rather than crypto and US small-cap stocks.

Why institutions matter more than retail

Retail traders like to point to retail-driven themes such as AI or meme plays. But the majority of global liquidity is controlled by institutions. Where institutions go can determine which macro themes dominate a cycle. In 2025, their flows favored international markets and metals. If that trend persists, it defines the backdrop crypto must navigate in 2026.

How International Flows Can Eventually Boost Crypto

International liquidity does not disappear. Eventually it will run out of suitable domestic outlets and look for new places to land. Crypto is a potential recipient once those international markets saturate. The timing and the specific crypto assets that benefit depend on two variables:

- Which countries open their doors to crypto? Regulatory clarity and infrastructure matter. If a jurisdiction makes it easy to hold and trade crypto, capital there will flow into available crypto products.

- Which crypto products are accessible and attractive to investors in those jurisdictions? Cultural preferences, local trading habits, and environmental concerns influence whether investors favor Bitcoin, Ethereum, large altcoins, DeFi tokens, or tokenized assets.

Below I unpack how these factors play out in key regions and the implications for a 2026 portfolio.

Regional Flows: Europe, South Korea, Canada — and What They Mean

Different regions will channel capital into crypto in distinct ways. Understanding these patterns gives investor-level insight into which tokens are likely to see demand.

Europe: regulated, exchange-focused, environmentally conscious

The European Union implemented Markets in Crypto Assets (MICA), creating clearer rules for listing crypto products on exchanges. But Europe also enacted strict travel rule regulations, which make off-exchange, on-chain activity more cumbersome. Couple that with a strong environmental consciousness among many European investors, and the path of least resistance becomes large exchange-listed altcoins and crypto ETPs rather than on-chain DeFi or proof-of-work coins.

Evidence supports this: several exchange-traded products in Europe hold not just Bitcoin but large altcoins like Ethereum, Solana and XRP. If European equity markets continue to attract liquidity, and investors begin looking further out along the risk spectrum, these large altcoins are the most likely crypto recipients.

South Korea: altcoin appetite and platform-driven trading

South Korean retail has a distinct profile. On-chain DeFi is constrained by regulation; trading tends to happen on centralized exchanges; and local traders favor altcoins with smaller nominal prices and perceived upside. XRP has been especially popular in Korea, and local exchanges often list small-cap altcoins that see significant local volumes.

Geopolitical events affect this flow. A reduction in tensions with North Korea, for example, could supercharge local risk appetite and speculative flows into crypto. When that happens, expect a surge into altcoins favored on local exchanges.

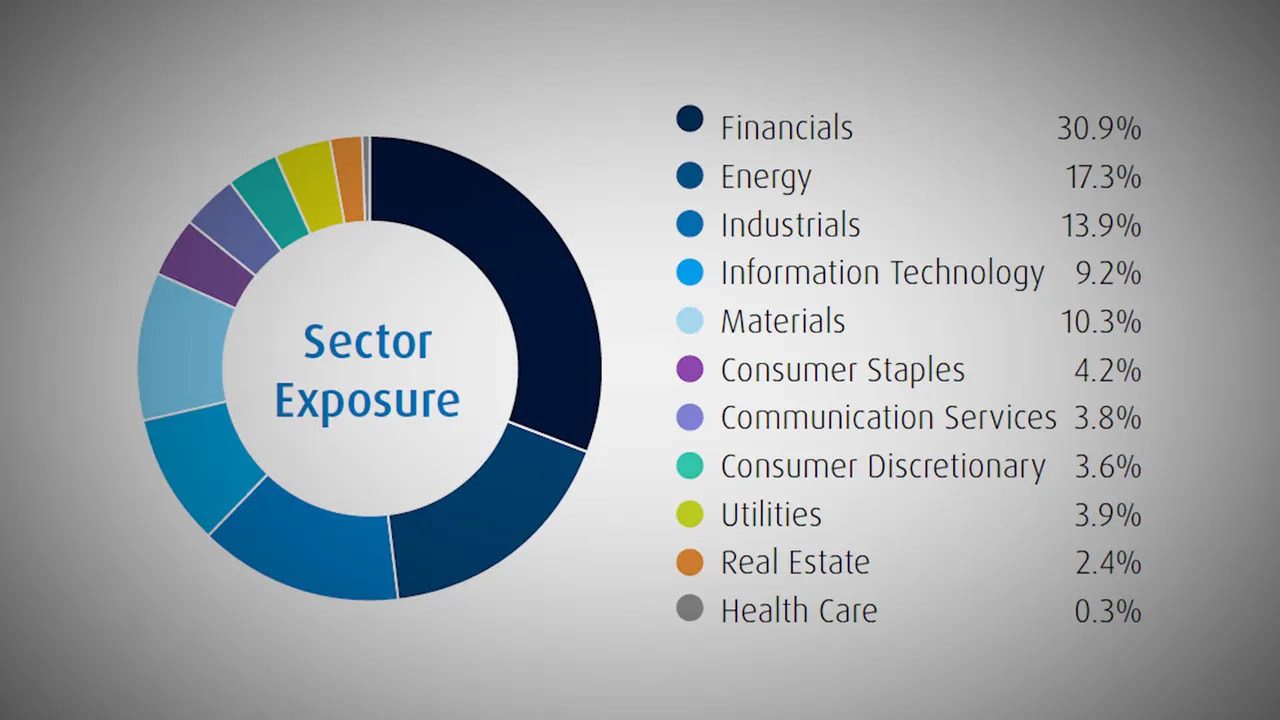

Canada: commodity-heavy markets and the home bias effect

Canada’s stock market is materially different from the US. Resource and commodity companies make up over a third of the TSX, whereas similar companies comprise less than 5 percent of the S&P 500. When US or global investors rotate into resource-heavy markets like Canada, locals see their equities rise and often look to allocate any new risk appetite into higher-beta assets. For many Canadian investors, crypto is an accessible way to increase risk exposure once their domestic market has run up.

In short: as international markets and commodities attract capital, eventually local investors in those markets redeploy gains into higher-risk assets; crypto is an easy outlet. The timing depends on how quickly international markets saturate with liquidity.

Two Crypto Niches to Watch in 2026: Stablecoins and Tokenized Assets

When thinking about 2026, focus on the niches that are easiest for institutional and international investors to access and that serve immediate needs:

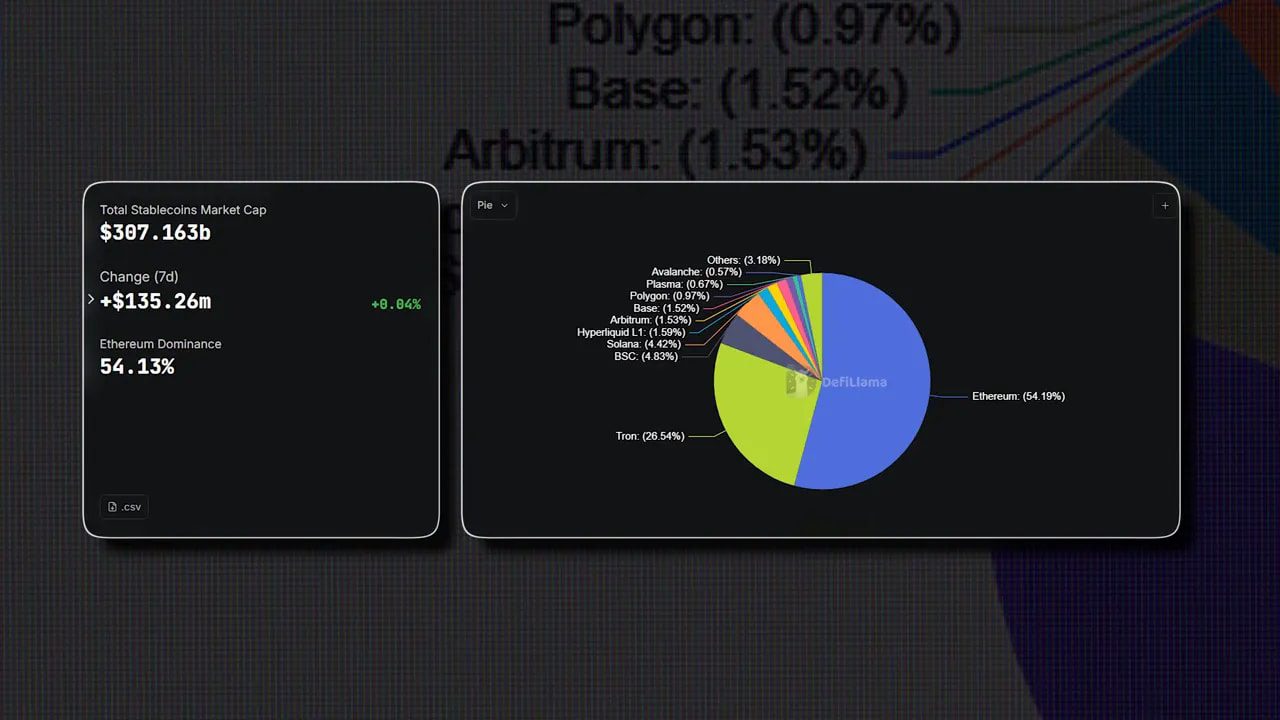

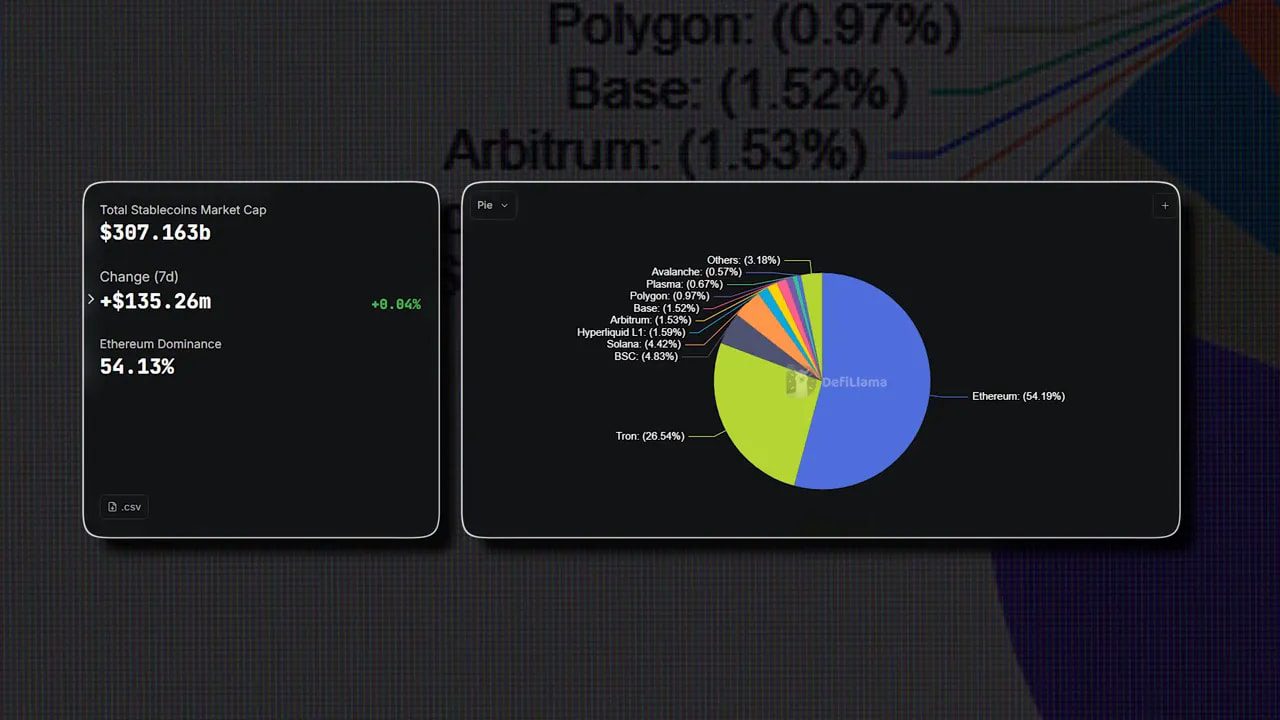

- Stablecoins — USD-denominated stablecoins are the plumbing for modern crypto trading and tokenized finance. Institutions and custodial platforms use them for liquidity and settlement. Regulatory clarity in major markets can accelerate institutional adoption of stablecoins as a store of value and a transactional medium inside crypto ecosystems.

- Tokenized real-world assets (RWA) — Tokenized gold was one of 2025’s breakout themes. Expect new tokenized offerings for other precious metals, bond tokens, and eventually tokenized equity. Tokenized assets provide a bridge between traditional capital markets and crypto rails.

Both niches are heavily concentrated on Ethereum today, which helps explain some of the price behavior we observed in 2025.

Why stablecoins and tokenized assets attract institutional interest

Stablecoins solve a simple problem: fast, programmatic liquidity denominated in a familiar currency. A corporate treasurer, an asset manager, or a sovereign wealth fund can use a regulated stablecoin to move capital quickly across rails. Tokenized assets allow the same players to gain exposure to commodities or bonds in a programmable, fractionalized form.

These products are far easier for institutions to integrate into workflows than speculative small-cap tokens or DeFi protocols that require on-chain counterparty and custody solutions that may not yet meet institutional risk policies.

What the Ratios Tell Us — and What They Don’t

Two metrics often discussed are ETH/BTC and Others/BTC (Others measures combined market cap outside of the top 10). Both have been trending higher in recent months — but the interpretation is nuanced.

- ETH/BTC rising can indicate money rotating from Bitcoin into Ethereum, often a precursor to broader altcoin strength. But it can also be explained by flows into Ethereum-based stablecoins and tokenized RWAs, which sit on Ethereum and boost ETH’s on-chain activity and demand even if spot ETH price falls in fiat terms.

- Others/BTC rising might reflect smaller altcoin strength, but it also includes stablecoins and tokenized assets. If tokenized gold, tokenized silver, or a wave of new RWA products gain traction, Others/BTC could rise because the “others” bucket grows via these assets rather than speculative altcoins.

Important caveat: ratios are relative measures. If Bitcoin falls 55 percent and Ethereum falls 50 percent, ETH/BTC will rise despite both assets losing significant fiat value. Ratios do not substitute for absolute price direction or macro context.

Is Ethereum the Better Anchor in 2026?

Given that many stablecoins and tokenized assets currently live on Ethereum, Ethereum has already seen relative strength to Bitcoin since mid-2025. If you have a longer time horizon and can tolerate deep drawdowns, Ethereum could serve as a portfolio anchor for the following reasons:

- It is the de facto settlement layer for a large share of stablecoins and RWAs.

- Regulatory clarity around stablecoins and tokenization in major markets creates on-ramps that favor Ethereum-based products.

- Infrastructure and ecosystem effects: most tokenized product developers and major stablecoin issuers prioritize Ethereum native deployments and EVM-compatible chains.

However, “could” is not “should.” Ethereum is still a volatile crypto asset. Historical cycles suggest 2026 could be a bear year across crypto, meaning ETH could drop another 50 to 70 percent from current levels before a meaningful recovery. If you can handle that volatility and have a multi-year horizon, ETH exposure may be rewarded; if you cannot, alternatives exist.

Stablecoins or Cash-Like Positioning as a Defensive Play

If you prefer not to stomach steep drawdowns, a defensive position in stablecoins might be the correct move. Stablecoins provide liquidity and optionality: you can redeploy quickly if a buying window appears. They are also central to many trading strategies, such as yield farming, liquidity provisioning, and arbitrage — but keep currency exposure in mind.

Currency risk matters. Most mainstream stablecoins are USD-denominated. If you live in a country that uses the euro or another currency and the US dollar falls in 2026, a USD stablecoin position could lose purchasing power in your home currency. Conversely, if the dollar rallies (historically associated with crypto bear years), USD stablecoins could preserve or even grow relative wealth in local terms.

Tokenized Gold (and Other Tokenized Commodities)

Tokenized gold and other precious metals present another anchor option. They combine the perceived safety of physical commodities with the tradability and programmability of tokens. If you expect commodities to remain strong or if you want inflation-resistant exposure, tokenized precious metals can be a tactical allocation. Remember, these tokens carry issuer, custody and counterparty risk, so choose reputable, regulated providers and understand redemption mechanisms.

Constructing an Optimized Crypto Portfolio for 2026

There is no single optimal portfolio that fits everyone. Your allocation depends on:

- Risk tolerance

- Investment horizon

- Currency exposure

- Regulatory comfort in your jurisdiction

Below are three framework examples to help you think about constructing a portfolio for 2026. These are illustrative, not prescriptive.

Conservative Framework — Preservation and Optionality

- Stablecoins: 50–70 percent — preserves liquidity and provides optionality for buying dips or deploying into tokenized assets.

- Tokenized gold or tokenized RWA: 15–30 percent — exposure to commodities or short-duration tokenized bonds for diversification.

- Ethereum (ETH): 10–20 percent — selective exposure to the token that hosts most stablecoins and RWAs.

- Small allocation to Bitcoin or BTC ETPs: 5–10 percent — long-term store of value exposure if you want diversification within crypto.

This approach minimizes volatility while keeping optionality to deploy when markets offer opportunities.

Balanced Framework — Growth with Risk Control

- Stablecoins: 30–40 percent — liquidity buffer and tactical dry powder.

- Ethereum: 25–35 percent — core growth exposure to tokenized economy activity.

- Tokenized assets: 10–15 percent — commodity tokens, tokenized bonds, or early-native token issuances from companies.

- Bitcoin: 10–20 percent — store of value, macro hedge.

- Altcoins (select large-cap): 5–10 percent — targeted positions in large altcoins favored by regional flows such as XRP, Solana, or others listed on major ETPs.

Aggressive Framework — High Conviction Growth

- Ethereum: 35–50 percent — dominant stake in the execution layer for stablecoins and RWAs.

- Altcoins (diversified, research-heavy): 20–30 percent — higher beta selection based on on-chain fundamentals and regional preferences.

- Bitcoin: 10–15 percent — maintained exposure to the original store of value.

- Stablecoins/tokenized assets: 10–20 percent — for tactical trading and selective tokenized exposures.

Whatever framework you choose, size positions so that you can hold through potential drawdowns. If a 50–70 percent drop would force you to sell, your allocation is too aggressive.

Practical Considerations and Execution

Building the portfolio is the first step; executing and managing it is equally important. Here are practical items to consider:

Token selection and custody

- Prefer reputable stablecoins with transparent reserves and regulated issuers where possible.

- For tokenized assets, verify the issuer, custody arrangements, redemption mechanisms and regulatory status.

- Use institutional-grade custody solutions or hardware wallets for long-term holdings; consider regulated custodial services for tokenized RWAs if you require easier operations.

Regulation and jurisdiction

Regulatory rules matter. In some regions, on-chain DeFi activity is effectively constrained by KYC and travel rules. Exchange-listed ETPs and regulated stablecoins will be the first bridges for institutional flow. Keep abreast of local regulatory changes that could open or close doors.

Taxation and reporting

Tokenized assets can introduce complex tax events. Understand how your jurisdiction treats stablecoins, token redemptions, and tokenized bond/coupon payments. Work with a tax advisor familiar with digital assets.

Rebalancing and risk controls

Set rules for how often you rebalance and at what thresholds. In volatile markets, periodic rebalancing (monthly or quarterly) with rules tied to drawdowns prevents emotional decision-making.

Trading Opportunities and Tools

Even if your long-term allocation skews conservative, short-term trading opportunities will arise as liquidity rotates. Typical plays to watch in 2026:

- Stablecoin yield strategies on reputable platforms once regulatory clarity and counterparty risk are acceptable to you.

- Tokenized commodity arbitrage — differences between spot commodity prices and tokenized versions can create opportunities for traders.

- Regional altcoin spikes — monitor exchange flows from Europe and Asia for signs of capital entering specific tokens favored by local traders.

Successful active trading requires timely information and robust signals. If you trade rotation flows or short-term opportunities, consider services that provide real-time market analysis and trade signals. Cryptocurrency trading signals can help identify entry and exit points based on liquidity shifts, on-chain flows, and regional trading volume anomalies. Use them as a complement to your own research rather than a substitute.

Timing: When Will International Liquidity Flow into Crypto?

Predicting exact timing is tough, but the mechanism is clear. International markets need to become saturated with liquidity before local investors begin redeploying into higher-beta assets. Several tail events could accelerate the shift:

- Resolution or de-escalation of geopolitical conflicts that have deterred international capital flows (for example, a meaningful decline in war-related risk).

- Further regulatory clarity that simplifies moving capital between on-ramps and crypto products.

- New tokenized product launches that offer compelling, regulated exposure to commodities or corporate shares.

Given current trends, expect 2026 to be a year of continued international market strength and likely muted crypto performance. The more explosive phases for altcoins and broad crypto adoption may occur later in the decade — 2027 to 2028 — once regulations and geopolitical clouds settle and liquidity seeks new outlets.

Do Stocks Like Circle or Coinbase Provide a Bridge?

Companies that sit at the intersection of fiat capital and crypto infrastructure are attractive in theory. Circle issues USDC; Coinbase plans to support tokenized RWA trading and issuance. Investing in these companies could give equity-like exposure to trends such as stablecoin adoption and tokenization.

Reality is more nuanced. Most of these stocks remain highly correlated to crypto at large and can be dragged down by market-wide crypto bear cycles. If you want indirect exposure while avoiding on-chain custody, equities like these are an option — but expect volatility and correlation to persist until the market matures further.

Checklist Before You Make Any Allocation

- Clarify your time horizon and the largest loss you can tolerate without panic selling.

- Decide whether you want to be primarily a holder of digital assets or an allocator of tokenized products.

- Assess your local regulatory environment and tax implications for holding stablecoins and tokenized assets.

- Choose secure custody options and diversify across counterparties to reduce single-point-of-failure risk.

- Set rebalancing and stop-loss rules in writing and commit to following them.

Signals, Research, and Execution — A Final Word

Markets in 2026 will favor those who combine macro insight with tactical execution. If you want to trade liquidity rotations, keep an eye on international equity flows, precious metal prices, on-chain stablecoin growth, and the proliferation of tokenized assets. Tools that provide timely market indicators and trade signals can be useful for spotting short windows of opportunity and managing entries in fast-moving markets. Remember: signals are most effective when paired with rigorous personal research and proper risk management.

Timeline Summary

- 2026: Expect the year to be dominated by international equities and commodities. Stablecoins and tokenized assets will be the key crypto themes to monitor. Bitcoin and broad altcoins are likely to remain under pressure by historical bear-cycle patterns.

- 2027–2028: As regulatory clarity improves and geopolitical risks potentially decline, liquidity may rotate into crypto more meaningfully. This period could reward altcoin rotation, starting with Ethereum and then moving into mid/large-cap altcoins.

Frequently Asked Questions

Should I sell all my crypto and convert to stablecoins for 2026?

That depends on your risk tolerance and currency exposure. Stablecoins preserve liquidity and optionality and can be appropriate if you cannot tolerate large drawdowns or expect to redeploy quickly. However, USD-denominated stablecoins carry currency risk relative to your home currency. A balanced approach often works better: keep a liquidity buffer while maintaining selective exposure to ETH and tokenized assets if you have conviction.

Is Ethereum a safer bet than Bitcoin for 2026?

Ethereum may be a better structural play if you believe stablecoins and tokenization will dominate institutional flows because many such products sit on Ethereum. But Ethereum remains volatile and is not “safer” in the traditional sense. If you can handle a potential 50–70 percent drawdown and have a multi-year horizon, ETH could outperform. If you need lower volatility, consider stablecoins or tokenized precious metals instead.

Which altcoins should I watch for international flows?

Large exchange-listed altcoins like ETH, SOL and XRP are the obvious materials to monitor because they’re widely accessible via ETPs in regions like Europe. Region-specific favorites (for example, XRP in South Korea) can also attract spikes. Focus on liquidity, exchange listings, and local trading volumes when assessing which altcoins are likely to benefit from regional inflows.

Are tokenized assets safe?

Tokenized assets have pros and cons. They offer fractional, on-chain exposure to real-world assets, but they introduce issuer and custody risks. Vet the issuer, understand how the underlying asset is stored and audited, and confirm redemption mechanisms. Regulatory status is also important: prefer tokenized products issued under clear legal frameworks.

How should I manage currency risk with USD stablecoins?

Consider hedging strategies or maintaining part of your liquidity in a local-currency stablecoin if available and credible. Evaluate forward contracts or FX hedges if you’re managing large exposures. Always factor expected changes in the US dollar into your allocation decisions.

Can trading signals help with this strategy?

Yes, especially for active traders. Signals that track on-chain flows, exchange order book imbalances, and regional volume spikes can highlight rotation points and short-term opportunities. Use signals as a complement to your macro framework and personal research. For long-term holders, signals are less critical but can still help with tactical rebalancing.

Final Thoughts

2026 is unlikely to be a straightforward year for crypto. International equities and commodities will continue to be dominant themes, and crypto could remain muted while those markets soak up liquidity. But that does not mean crypto is irrelevant. Instead, it means investors should be tactical.

Focus on niches that match where institutional and regional liquidity is most likely to flow: stablecoins and tokenized assets (primarily on Ethereum). Use stablecoins for liquidity and optionality, consider tokenized commodities and bonds for defensive exposure, and maintain selective ETH exposure if you have a long horizon and can tolerate volatility. Watch regional trends — European ETPs, South Korean exchange volumes, and Canadian market behavior — for clues about where the next wave of crypto demand will originate.

Finally, if you trade or intend to trade rotation opportunities, pairing your research with professional-grade market data and cryptocurrency trading signals can improve execution timing. Signals are not a silver bullet, but they can give you an edge in a market where timing and liquidity flow matter.

Markets evolve. Be ready to adapt when liquidity completes its detour and starts flowing back into crypto. When that happens, the next cycle could be explosive — and the portfolios that positioned intelligently in 2026 will be the ones that benefit the most.