Table of Contents

- Why this isn’t gambling (and why it can work)

- The core concept: trade the 50 percent of the manipulation

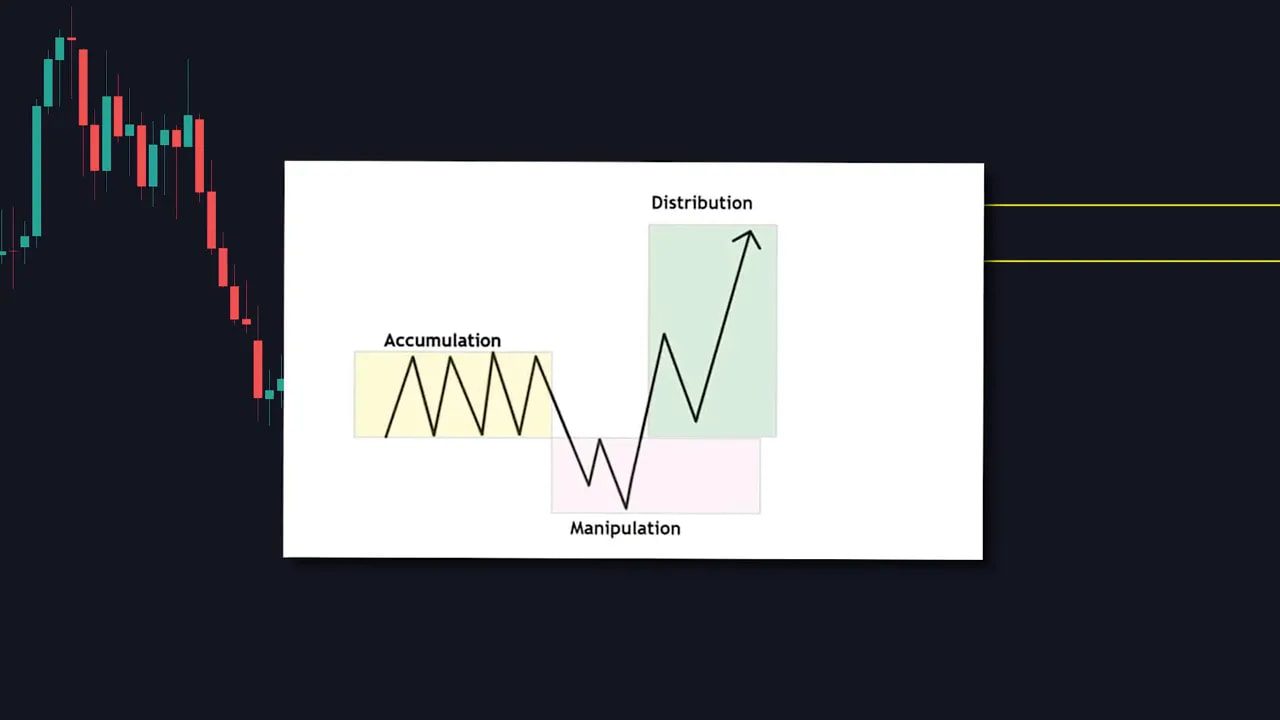

- Behavioral edge: accumulation, manipulation, distribution (AMD)

- Multi-timeframe rules: how to spot a valid setup

- Entry technique: fair value gaps and inverse fair value gaps

- Risk management: target 50 percent, scale, and break even

- Adapting this framework to crypto and other markets

- Step-by-step checklist to try the setup

- What to expect and common pitfalls

- Quick example (what a textbook trade looks like)

- How do I measure the 50 percent target?

- Final notes

Why this isn’t gambling (and why it can work)

The idea is surprisingly simple: instead of trying to hit a home run, target the easy base hits—the small, highly probable moves that happen repeatedly when the market behaves predictably. Measure a trend, watch for a manipulation, then trade to the 50 percent retracement of that manipulation. Do that often enough with discipline and the right risk management, and the edges add up.

The core concept: trade the 50 percent of the manipulation

When price moves sharply and then reverses, it frequently retraces to roughly 50 percent of the original range. The system isn’t trying to catch the full move. It only targets the halfway mark of a manipulation move—an easier, more probable target.

Two outcomes make this attractive:

- If the overall trend continues with your trade, you capture a large portion of the move.

- If the market reverses against you, it will often correct first back toward the 50 percent level, letting you take profit and quickly move to break even.

In short: aim for the high-probability retracement, not the unknown bottom or a perfect reversal.

Behavioral edge: accumulation, manipulation, distribution (AMD)

This method leans on a century-old insight into market psychology. Price tends to:

- Accumulate—sideways action where participants build positions.

- Manipulate—a breakout that lures retail traders into one side of the market.

- Distribute—the move that follows when larger players take the opposite side and hit stop losses for liquidity.

Retail traders often buy breakouts and set stops above or below obvious levels. When the breakout fails, those stops provide the liquidity that fuels the opposite move—the exact move this strategy trades.

Multi-timeframe rules: how to spot a valid setup

Use a top-down approach to confirm the manipulation and the likely retrace.

- On the daily timeframe, before the market opens, mark that candle’s high and low. These are probable liquidity points.

- Move to the 4-hour timeframe to identify a longer accumulation range. You want to see price consolidating into the open.

- Watch the session between 9:30 and 11:30 AM Eastern, with particular attention around 10:00 AM. Many manipulations occur in that window.

- Use the 1-hour timeframe for your precise entry once the manipulation shows confirmation.

If the daily high/low is breached within the morning window and the 4-hour shows accumulation, the odds favor a manipulation that will produce the retrace you are targeting.

Entry technique: fair value gaps and inverse fair value gaps

The entry model uses fair value gaps (FVG). A fair value gap appears when price moves so fast that there is an imbalance—essentially a gap between a candle’s wick and the following candle.

Mark the gap from the top wick before the big move to the bottom wick after the big move. That zone is a natural magnet for price to retest.

An inverse fair value gap happens when a bullish gap is created then broken hard to form a bearish gap inside the bullish one. That inversion is a strong signal that sellers have taken control and is an ideal short entry when confirmed by higher timeframe accumulation and the morning manipulation.

Risk management: target 50 percent, scale, and break even

Risk management is the engine that turns the edge into a real strategy. Follow these rules:

- Set your initial take profit at 50 percent of the manipulation move.

- When price hits that 50 percent level, sell 50 percent of your position and move the remaining position’s stop loss to break even.

- If the move continues in your favor, scale out further at the lows of the original move.

The outcome: many trades end up as break even, a portion become small wins, and a few will capture larger trend-following profits—all while protecting capital from catastrophic reversals.

Adapting this framework to crypto and other markets

The same psychology applies to crypto markets—accumulation, manipulative breakouts, and liquidity-driven moves happen there too. Crypto’s higher volatility can produce more and faster fair value gaps, so the entry and risk rules become even more important.

If you trade across blockchains and want help spotting high-probability setups, using the best crypto rading signals can complement this strategy. Signals that highlight liquidity zones, morning manipulations, and fair value gaps let you focus on execution and risk control rather than endless screen time.

Step-by-step checklist to try the setup

- Open TradingView and set the timezone to Eastern if you trade U.S. hours.

- On the daily chart before the open, mark the session high and low.

- Check the 4-hour for accumulation into the open.

- Between 9:30 and 11:30 AM, watch for a break of the daily high/low and a manipulation around 10:00 AM.

- Identify fair value gaps on the 1-hour and look for inverse FVGs for strong entries.

- Enter with a stop above/below the manipulation extreme, set TP at 50 percent, and plan to scale out 50% at TP and move stop to break even.

What to expect and common pitfalls

- Patience required. This setup does not appear every morning. Waiting is part of the edge.

- Risk in strong trends. When the market runs, reversals can be weak. That’s why strict TP and break-even rules are essential.

- Many break-even trades. That’s expected and intentional—you are protecting capital and trading probabilities.

- Discipline to only take setups that meet all the criteria is the hard part, not the theory.

Quick example (what a textbook trade looks like)

You see daily consolidation into the open, the 4-hour shows accumulation, and the morning session breaks the daily high. Price manipulates down, creates an inverse fair value gap, and then retraces up to that gap. You short at the gap, place a stop above the manipulation high, and set TP at 50 percent of the original manipulation range. Price hits TP, you sell half and move stop to break even. If price keeps falling, you scale out more at the original low and lock in larger profit.

How do I measure the 50 percent target?

Measure from the start of the manipulation move (the high or low before the rapid move) to the extreme of the manipulation. The 50 percent target is the midpoint of that range. Use your chart ruler tool to mark that level precisely.

Can I use this method for long trades?

Yes. Flip the logic: look for bullish accumulations, bullish fair value gaps, or inverse bullish gaps after a downward manipulation. Target the 50 percent retracement to capture the probable short-term bounce.

Does this work in crypto?

The same behavioral dynamics apply in crypto. Volatility often produces more frequent fair value gaps, so the rules for stop placement and scaling become even more important. Consider combining this framework with trusted crypto signals that highlight liquidity and manipulation zones.

What if price never retraces to 50 percent?

That can happen. The system accepts a number of break-even outcomes as the cost of avoiding large losses. If the trade never reaches TP but moves favorably first, you should still move stops to break even after selling partial position at the 50 percent level to eliminate downside risk.

Final notes

This is a probability-based approach that combines higher-timeframe context, an entry model based on market imbalances, and disciplined risk management. It is not a silver bullet, but it is repeatable and logical.

Practice the rules on a demo account, build a checklist for entries, and be comfortable with frequent small wins and many break-even trades. When you get the routine down, the strategy rewards patience and discipline.