The Best scalping trading strategy is not about predicting perfect bottoms or picking exact reversals. It is about stacking probability in your favor by trading with the trend, using a handful of indicators to confirm momentum, and keeping risk management strict. Below I lay out a clear set of rules, the indicators to add in TradingView, and practical tips so you can scalp Forex, stocks, or crypto with confidence.

Table of Contents

- Why trade with the trend

- What you need (indicators and setup)

- Step-by-step rules

- How to manage risk and take profit

- Example flow (what a real trade looks like)

- Tips for applying this strategy to crypto, Forex, and stocks

- Practical notes and common pitfalls

- FAQ

Why trade with the trend

Trade with the chart, not against it. Attempting to buy the absolute low on a downtrend is a low-probability game. This strategy focuses on catching momentum when the market is already biased higher. That means fewer trades, higher win-rate potential, and less emotional decision making.

What you need (indicators and setup)

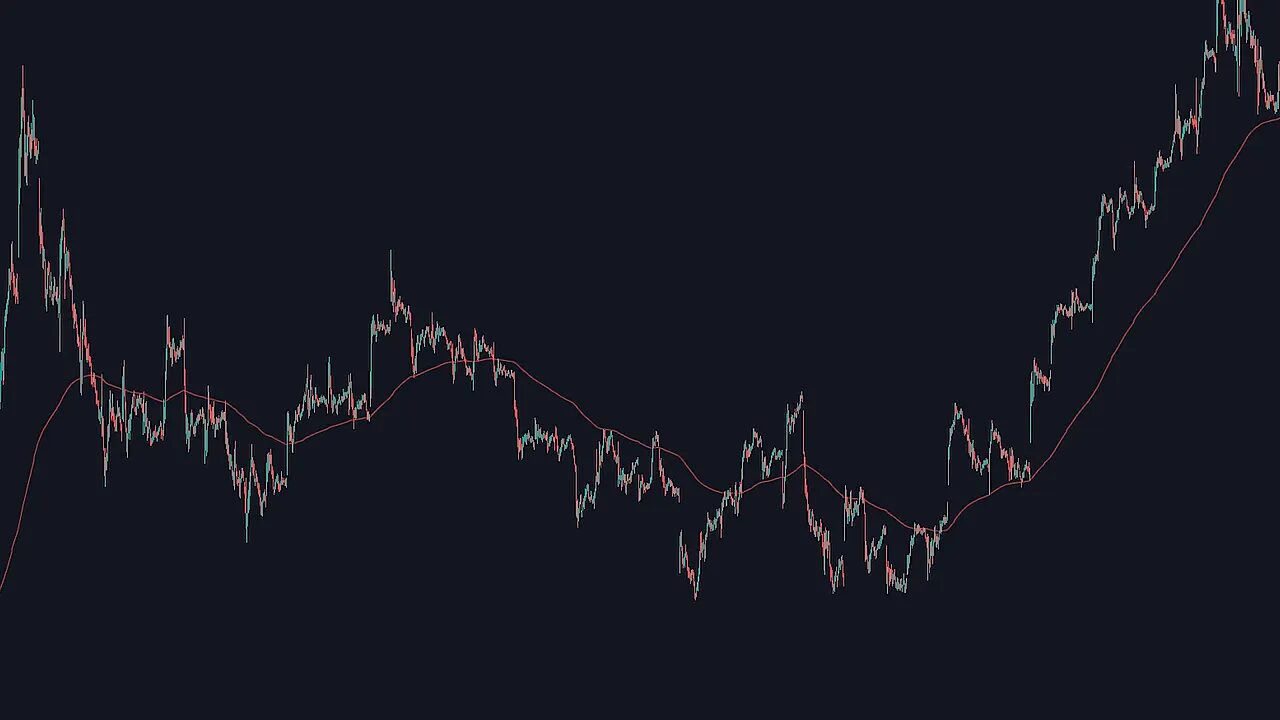

- 200 EMA (exponential moving average) set to length 200. Use this to define the trend: price above = uptrend, price below = downtrend.

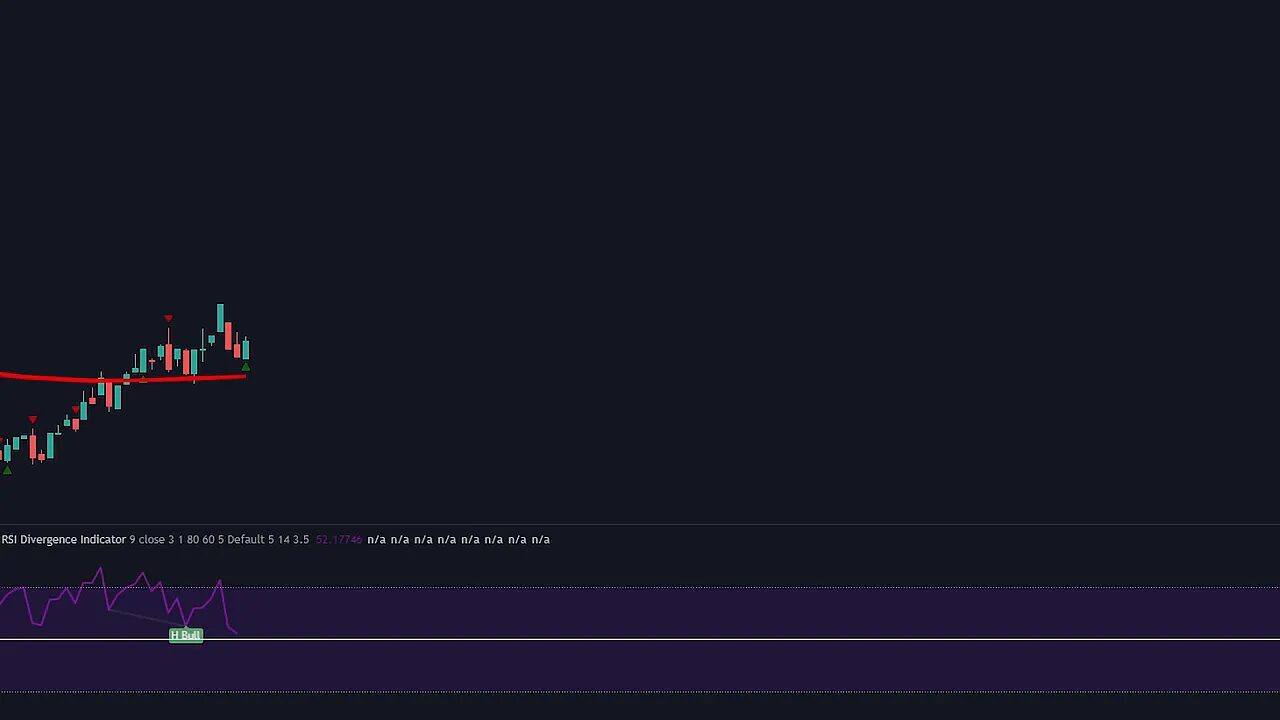

- RSI divergence indicator (customized). Use it for momentum confirmation and optional bullish divergence signals.

- Engulfing candle indicator. It marks bullish engulfing candles so you do not have to scan the chart constantly.

Step-by-step rules

-

Rule 1 — Only trade with the trend

Entry is allowed only when the price is above the 200 EMA. If price is below the 200 EMA, skip the trade. This simple filter removes many low-probability entries.

-

Rule 2 — RSI must show momentum

Add the RSI divergence indicator and adjust its display (hide clutter and make the middle line easy to see). Only enter when the RSI line is above the middle (50) line. This ensures momentum is in your favor.

The RSI can also display bullish divergence, which is a nice bonus when it lines up with the other rules, but divergence is not required for entry.

-

Rule 3 — Wait for a bullish engulfing candle

Use the engulfing candle indicator. Only enter after a green arrow appears and the candle has fully closed. An engulfing candle indicates a momentum shift and often marks the beginning of a stronger move.

How to manage risk and take profit

Once all three rules are satisfied, place an entry and manage risk as follows:

- Stop loss: Set your stop loss to two times the length of the entry (engulfing) candle. This gives room for volatility while keeping risk logical.

- Take profit: Use a 2:1 reward-to-risk ratio. If your stop is 10 pips, target 20 pips. If your stop is $50, target $100.

- Only enter after the engulfing candle closes. A forming candle can show an arrow and later fail to close as an engulfing candle.

If you get nervous during trades, set your stop loss and take profit, then step away. Emotion-driven exits are often what ruin otherwise good trades.

Example flow (what a real trade looks like)

- Confirm price is above the 200 EMA.

- Confirm RSI is above the 50 line; bonus if there is bullish divergence.

- Wait for a green arrow (bullish engulfing) and allow the candle to close.

- Enter, set stop loss to 2x candle length, set take profit at 2:1, and manage nothing else — let the plan play out.

Tips for applying this strategy to crypto, Forex, and stocks

This approach translates across markets and timeframes. Crypto tends to be more volatile, so you might see more frequent engulfing candles and larger candle lengths. That makes strict position sizing essential. If you scalp crypto, consider small position sizes and stick to the stop rule to protect capital.

For traders looking for trade ideas on crypto blockchains, a free crypto signal service can help you spot setups that meet the trend and momentum filters. Use signals as a scanning aid, then apply the three rules above before entering a position.

Practical notes and common pitfalls

- Do not try to trade every day. The market will not be trending 100 percent of the time. Patience pays.

- Do not move stops or take profits out of greed or fear.

- The RSI divergence indicator may occasionally miss divergence. Learn to spot divergence visually as a backup.

- Only take entries after candle close to avoid false signals.

Probability and success rate beat guessing and hoping. Let the chart tell you when to act.

FAQ

How do I tell if the market is in an uptrend?

If price is above the 200 EMA you consider the market in an uptrend for this strategy. Only long entries are allowed while price remains above that line. If price falls below the 200 EMA, stop taking long trades.

Which timeframes work best for this system?

This method works on multiple timeframes. Scalpers often use 1-minute to 15-minute charts, while swing traders can apply the same rules on 1-hour or 4-hour charts. Select a timeframe that matches your trading style and account size.

How do I size my position with the 2x candle stop loss?

Measure the entry candle body length, multiply by two for your stop distance, then calculate position size so that the dollar risk equals your predetermined risk per trade (for example 1 percent of account equity). This keeps risk consistent.

Can I use this on cryptocurrency markets?

Yes. Crypto is well suited to this trend-and-momentum approach, but expect higher volatility and wider stops in many pairs. Consider using a free crypto signal to discover candidates that already meet trend and momentum criteria, then apply the strategy rules before entering.

What if the engulfing indicator shows an arrow but the candle later fails?

Only act after the candle closes. Indicators can mark preliminary patterns while a candle is still forming; a closed candle is what confirms the pattern.