Table of Contents

- Overview: Why Tradoor is on traders’ radars

- What Tradoor offers: product and traction

- Key milestones that matter for price

- Price dynamics and volatility

- Realistic scenarios: path to $10

- How traders can approach Tradoor

- Key takeaways for a Tradoor Price Prediction

- What makes Tradoor different from other derivatives platforms?

- Final thoughts

Overview: Why Tradoor is on traders’ radars

Tradoor Price Prediction is a hot topic because Tradoor combines a highly usable derivatives platform with rapid token adoption. The protocol launched recently and already shows the traits that attract day traders: low cap, big percentage swings, and moments of very high volume. These characteristics make Tradoor appealing for short-term traders and a speculative long-term hold for those who believe in its product-market fit.

What Tradoor offers: product and traction

Tradoor is built around trading options and perpetuals on web, mobile, and Telegram. Its product highlights include one-tap private trades, orders converted in roughly 50 milliseconds, and an on-chain privacy layer to reduce front running. That privacy and the promise of zero hidden costs make it attractive to leverage traders who need fast execution without being picked off by bots.

The platform also introduced Quant AI, an autopilot trading tool that can accept voice or text instructions and run strategies 24/7. If configured properly, this can be a powerful assistant for active traders, though anyone using leverage should understand the risks before enabling automated strategies.

Key milestones that matter for price

Tradoor has ticked several credibility boxes quickly: multiple product upgrades, institutional capital, impressive volume spikes, and a rapidly growing on-chain holder count. Notable points that feed into any Tradoor Price Prediction:

- Fundraising: Several well-known crypto funds participated in a multi-million dollar raise, giving the team runway for product expansion.

- Upgrades: Turbo Mode and a zero-gas trading UI dramatically improved user experience and lowered friction for traders.

- Volume: Daily perpetuals volume has topped tens of millions, with occasional surges above a hundred million on busy days.

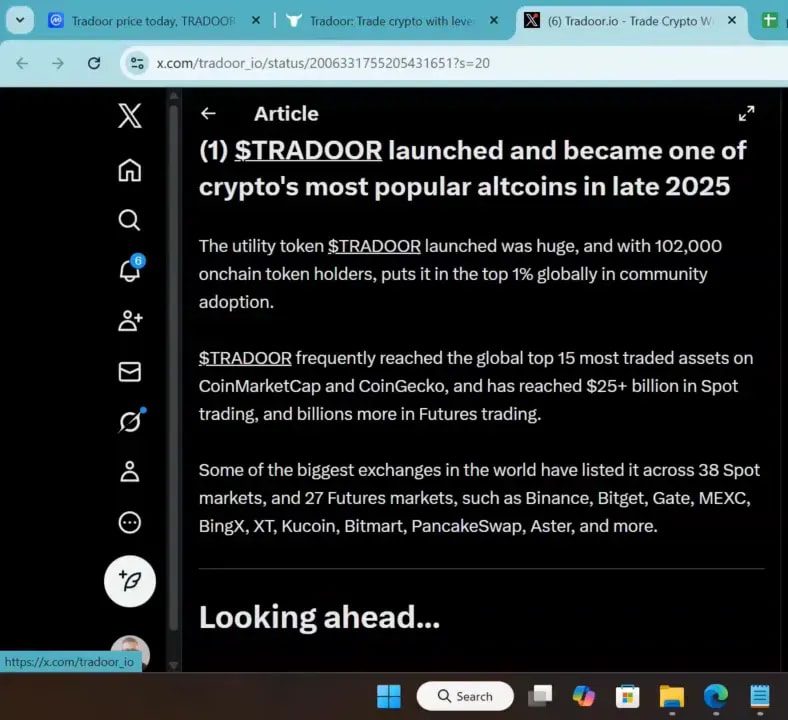

- Adoption: Over 100,000 on-chain token holders, placing the token among the top percentile by holder count for its age.

Price dynamics and volatility

Volatility is central to any realistic Tradoor Price Prediction. The token has delivered large intra-day swings since launch. That makes it a promising play for swing traders and day traders but a nerve-wracking asset for conservative holders. If listings on more major exchanges occur, the next phase of price discovery could be dramatic — in either direction.

On the bullish side, strong product usage, expanding listings, and continued feature rollout could push the token toward larger market caps. On the bearish side, dramatic percentage pullbacks and the token’s youth make it vulnerable to sentiment shifts and liquidity squeezes.

Realistic scenarios: path to $10

A reasonable Tradoor Price Prediction framework considers three variables: market cycle strength, exchange listings, and sustained volume. If the broader bull market stays strong and Tradoor earns listings on more top-tier exchanges while maintaining high derivative volume, a move toward $10 is within the realm of possibility. That said, such a move would likely require continued product adoption and multi-chain expansion.

- Conservative case: Flat to modest gains, with choppy trading and sideways price action.

- Base case: Several exchange listings and steady UX growth, producing a multi-bagger move over time.

- Optimistic case: Continued volume surges, institutional partnerships, and wide listing adoption drive a rapid run toward and beyond $10.

How traders can approach Tradoor

For active traders, Tradoor is attractive for leveraged perpetuals and options, given its low latency and simple UI. Use smaller position sizes initially, set strict stop losses, and treat automated tools as assistants rather than autopilots unless you thoroughly backtest your strategy.

For investors considering Tradoor as a speculative longer-term holding, evaluate adoption metrics — daily active traders, perpetuals volume, and token holder growth — rather than short-term price noise. Combining on-chain data with product milestones gives a clearer signal than chart patterns alone.

If you want timely trade ideas to navigate this kind of volatility, a well-curated signals.com/blog/how-to-use-your-crypto-signals-for-maximum-profit-a-step-by-step-guide” target=”_blank”>crypto signal service can help you identify entries, set targets, and manage risk on fast-moving tokens like Tradoor. The right signals are especially helpful when volume spikes create large intraday moves and when new exchange listings approach.

Key takeaways for a Tradoor Price Prediction

- Adoption-driven: Product traction and listings will dictate the major price moves.

- High volatility: Great for traders, risky for position traders without strong risk management.

- Potential upside: $10 is possible under optimistic conditions but not guaranteed.

- Use signals and risk controls: Leverage and automated tools amplify both gains and losses; signals can help time the market.

What makes Tradoor different from other derivatives platforms?

Tradoor emphasizes ultra-fast order conversion, on-chain privacy to reduce front running, and an intuitive interface across web, mobile, and Telegram. It also offers Quant AI for automated strategies, which differentiates its product set from many peers.

How risky is Tradoor as an investment right now?

Tradoor is high risk due to its low market cap and large price swings. It is suited to traders who understand leverage and speculative investors who accept the possibility of significant drawdowns. Evaluate use metrics and listing momentum before committing large capital.

Can Tradoor reach $10 this bull cycle?

A move to $10 is possible in a strong bull market with continued product adoption and more exchange listings. However, significant volatility and the token’s youth mean this outcome is speculative and dependent on several favorable events occurring.

Should I use automated trading or signals for Tradoor?

Automated trading can be effective if parameters are well tested. For most traders, combining disciplined automation with a trusted crypto signal service helps manage entry and exit points while maintaining risk controls during volatile runs.

Final thoughts

Tradoor Price Prediction hinges on adoption, listings, and sustained volume. It checks many boxes that make it a compelling trading token, but the same factors that create explosive upside also create steep downside risk. Treat it as a speculative position, size carefully, and rely on disciplined signals and risk management to navigate the swings.

Smart risk management and an informed approach will be the deciding factor between a profitable trade and a painful lesson in volatility. Stay focused on the underlying metrics rather than the hype, and let adoption and volume guide your Tradoor Price Prediction expectations.