Table of Contents

- Start small, plan smart: the three rules that actually move the needle

- 1. Squeeze every bit of value from your risk to reward

- Why patience beats aggression

- 2. Trade for consistency, not headline returns

- 3. Protect the capital that lets you trade another day

- Trading small accounts across markets and blockchains

- Checklist: A disciplined routine for growing a small account

- Conclusion

- Frequently asked questions

Start small, plan smart: the three rules that actually move the needle

Growing a tiny trading account is less about heroic swings and more about smart math, patience, and repeatable habits. With just $100 you can build a thriving account if you treat every trade like a business decision, not a gamble. Below are three practical principles that make compounding possible without blowing up your balance.

1. Squeeze every bit of value from your risk to reward

Most beginners place an entry, then set a stop loss well below the nearest strong support and a take profit at a distant resistance. That works, but it leaves return on risk on the table.

Identify three levels on your chart: a strong support, a nearby resistance that could become support on a pullback, and the ultimate profit target on a higher timeframe. Be patient. If price breaks the nearby resistance, do not immediately enter. Wait for the pullback and a bounce that creates more confirmations for the new level.

When that bounce happens, the former resistance becomes a stronger support and you can place your stop loss tighter, directly below that new support instead of far below the originally identified strong support. Same take profit, smaller risk. The result is a much higher risk to reward.

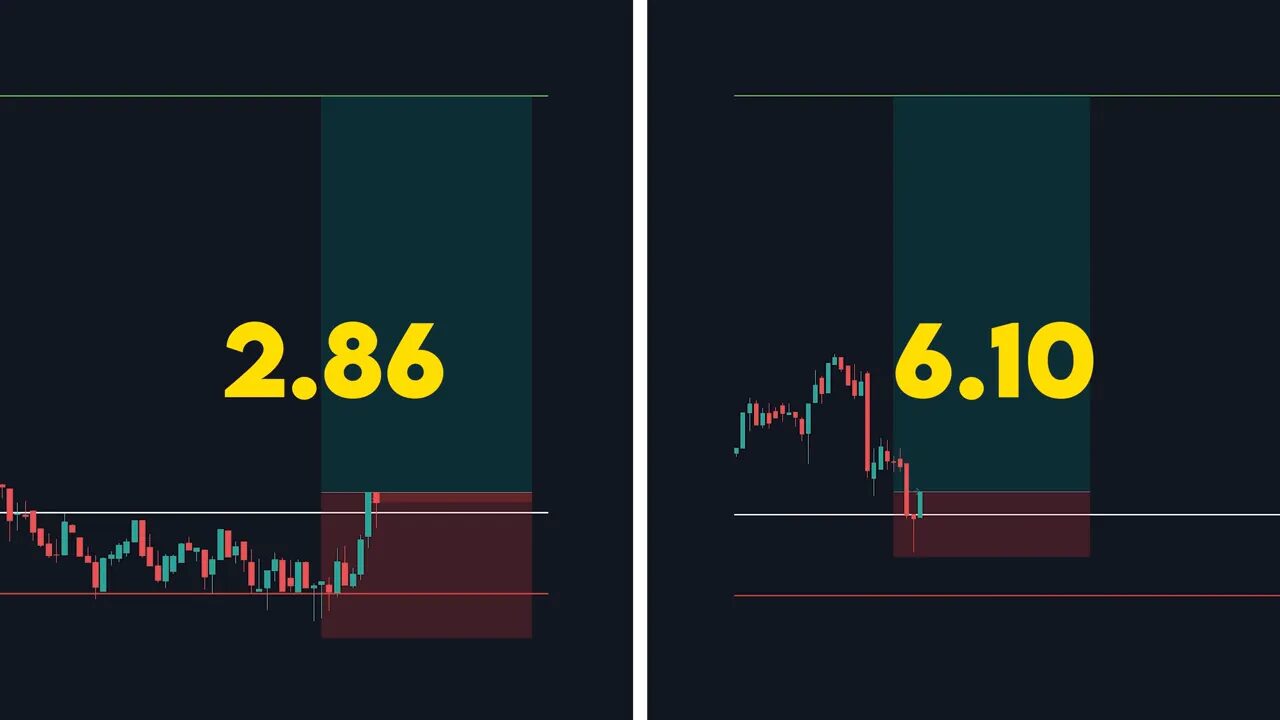

Example: entering on breakout without waiting gives a risk to reward around 2.7:1. Waiting for the pullback and moving the stop up can increase that to about 6.1:1. You are capturing the same upside while risking far less capital. Over many trades, that difference compounds dramatically.

Why patience beats aggression

Trading is patient people taking money from impatient people. Waiting for confirmation does two things: it increases the reliability of the level and it improves your math. Setups that look identical in price can have very different edge depending on where your stop sits. Make the math work in your favor.

2. Trade for consistency, not headline returns

High per-trade profit targets sound sexy. Doubling or tripling quickly is tempting, but those strategies are rare and hard to execute consistently. Instead, aim for smaller, achievable targets that you can hit frequently.

Compare two approaches starting with $100:

- Trader A targets 20% per trade and finds only a few setups per month. Even with wins, opportunities are limited and volatility of returns is high.

- Trader B targets 2% per trade and can execute many low-risk, repeatable setups. Over time Trader B compounds faster and with less stress.

Smaller targets allow more trades, and more trades mean more chances for your edge to express itself. Focus on execution quality and repeatability. Compounded small wins beat occasional big wins that require luck.

3. Protect the capital that lets you trade another day

How much you risk per trade determines whether a losing streak becomes a temporary setback or an account wipeout. High risk per trade might win big, but it exposes you to catastrophic drawdowns.

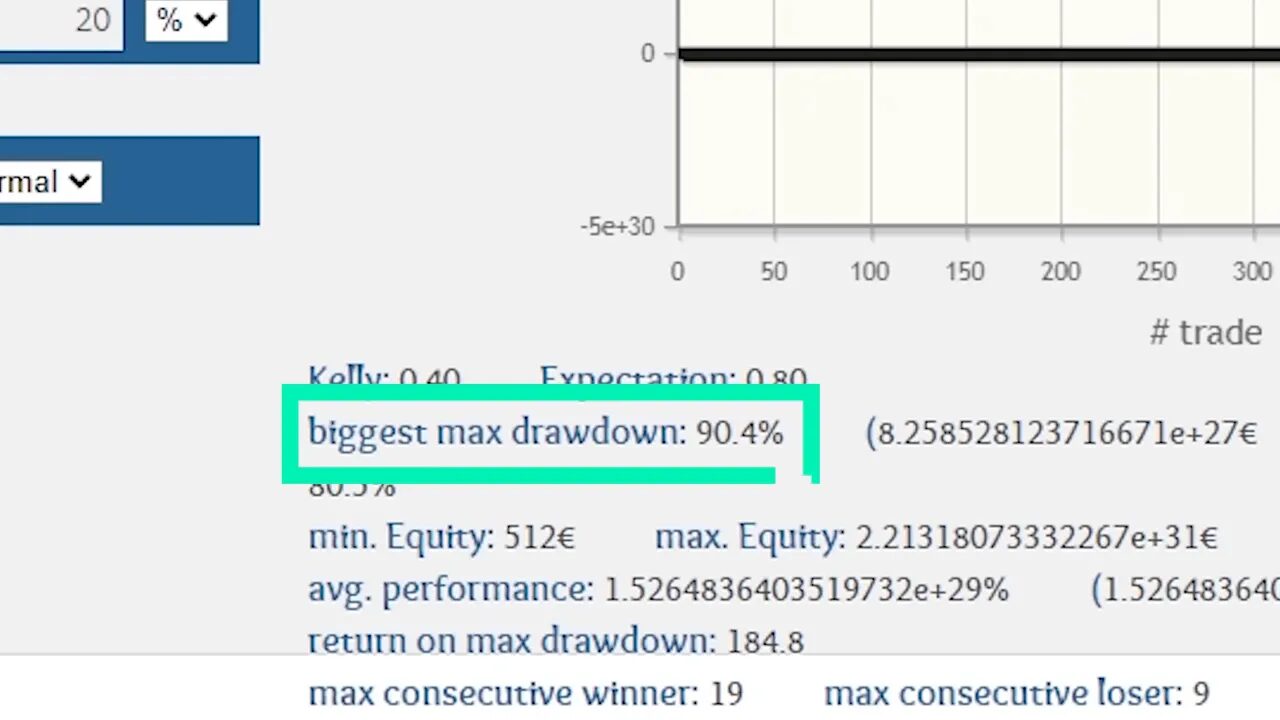

Use a simulator mentality to understand the worst case. With a 60 percent win rate and 2 wins for every loss, risking 20 percent per trade can produce a maximum drawdown over 90 percent. Risking 50 percent often means losing everything. Contrast that with risking 2 percent per trade, where the largest potential drop sits around 15.5 percent.

Risking 1 to 2 percent per trade preserves your ability to survive multiple losing streaks and lets the math of edge work for you. If your strategy is sound, longevity plus compounding wins will outperform aggressive one-off bets every time.

Trading small accounts across markets and blockchains

Small account principles apply equally to stocks, forex, and crypto. Crypto markets can offer rapid moves and many tradable setups, but they also have higher volatility. When trading smaller accounts in crypto, that volatility becomes both an opportunity and a risk.

Using a reliable information edge helps. A good crypto trading signal service can surface high-probability setups across different blockchains, saving time on scanning and helping you apply the same 1 to 2 percent risk rules across more opportunities. Signals are not a shortcut to guaranteed profits, but when combined with strict risk management and proper sizing they can increase the number of quality trades you take without compromising longevity.

Checklist: A disciplined routine for growing a small account

- Mark strong support and resistance on multiple timeframes.

- Wait for pullbacks and confirmed bounces before entering.

- Target realistic, repeatable profit levels. Prefer many small wins over rare big ones.

- Risk 1 to 2 percent of your account on each trade.

- Use stop losses that reflect technical structure, not emotion.

- Track trades and review edge over time. Let compounding do the work.

Conclusion

Growing a small trading account is doable. The three levers that actually matter are maximizing risk to reward through patience, prioritizing consistency of small wins, and protecting capital with sensible per-trade risk. Follow those rules, treat each trade like a business decision, and your $100 has a real chance to grow into something meaningful.

If you trade crypto, layering disciplined position sizing with curated market signals can help you find better opportunities while maintaining the same conservative risk per trade. Use signals to increase the quality and frequency of setups, not to justify bigger risks.

Frequently asked questions

Is it realistic to grow $100 into a substantial account?

Yes, but it takes disciplined risk management, consistency, and time. Focus on repeatable setups, protect capital by risking 1 to 2 percent per trade, and let compounding work in your favor rather than chasing outsized returns quickly.

How do I choose my stop loss and take profit levels?

Base stops and targets on technical structure. Use strong supports and resistances drawn from multiple timeframes. Prefer tighter stops once a level has been confirmed by a pullback and a bounce. Keep the take profit at logical higher timeframe resistance so risk to reward remains favorable.

What win rate and profit target should I aim for?

There is no universal number, but aim for a realistic combo that produces consistent edge. Many successful traders target small profits per trade, such as 1 to 3 percent, while maintaining a reasonable win rate. Consistency beats large but infrequent winners.

Can crypto trading signals help a small account?

Yes, when used wisely. Signals can point you to high-probability setups across chains, increasing the number of quality trades you can take. Always pair signals with strict position sizing and stop loss discipline so you do not overexpose a small account.